|

Key point:

Coinbase has opened up a unique Niche Market in the complex crypto world. "Whether it can dominate the US crypto infrastructure" and "whether the crypto economy will become an important part of the real economy" will determine how far Coinbase can go.

As one of the largest Bitcoin Listed Company holders in the world, MicroStrategy's core SaaS business limits Downside Risk, while using low-cost funds to continuously buy Bitcoin for a long time gives it considerable upside potential.

As a leading Bitcoin mining company, Marathon's business is essentially energy arbitrage. Differentiated operational capabilities, hardware upgrades, and energy utilization strategies will become the core competitiveness for mining companies to surpass Bitcoin returns and successfully cross cycles.

All innovation cycles begin with speculation. Technological progress stimulates market expectations, and inflated expectations support an industry's ultra-high valuation. Speculation often leads reality, while fundamentals take time to catch up.

The internet has been like this for decades. Although it also suffered the pain of the bursting of the bubble in the late 1990s, today it has incubated a group of the world's largest market capitalization and highest profit companies.

The crypto market may face similar challenges. It is obviously a lie to say that the rapid expansion of this market in the past decade was driven by pure fundamentals rather than speculation. The current question is, if this market gradually emerges from the late stage of the bubble, what is the true value it can leave behind? What are the representative companies in this industry?

Starting from the present, the RockFlow investment research team will introduce to you which of the current US stock companies are expected to survive as long-term participants in the crypto market and grow into true behemoths.

COIN: An important player in leading infrastructure construction and attracting institutional investors

Coinbase has opened up a unique Niche Market for itself in the complex crypto world. Its history can be traced back to 2012, starting from an early Bitcoin-centric platform incubated by Y Combinator. More than a decade later, Coinbase has become the leading exchange for buying and selling cryptoassets and has been pursuing compliance.

In the past two years, Coinbase has been striving to diversify its business scope, no longer limited to exchanges, but expanding to the entire blockchain technology field, from wallet infrastructure to staking services to on-chain expansion solutions. The previous L2 rollup Base is a typical example.

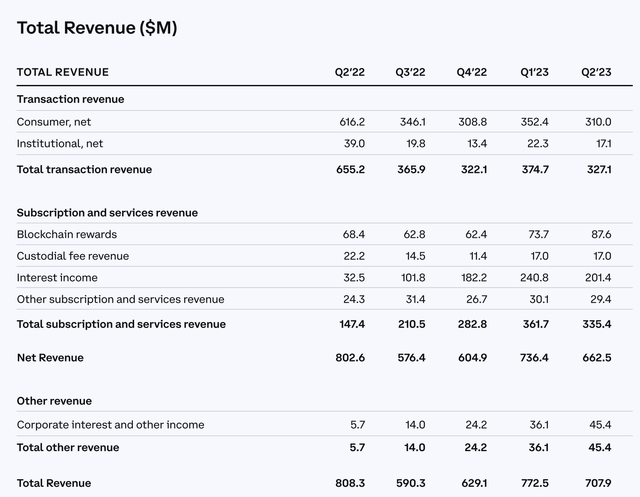

At the same time, its income sources are also significantly diversified: the trading income of individual users continues to decline (the fundamental reason is the sharp drop in BTC and ETH prices in recent quarters), while other types of income are surging. Especially interest income, which increased rapidly from $32.50 million in the previous year to $201.40 million in Q2 2023. The following chart shows the important financial data of Coinbase in the past five quarters:

In this turbulent emerging industry, Coinbase is establishing a trustworthy reputation, which is the product of unwavering commitment, transparent operations, and user-centered methods. This trust is not only reflected in its trading platform, but also in diversified products - from multi-functional financial products such as savings and rewards to Coinbase debit cards, and then to entering Web3. Coinbase's ecological strategy is slowly unfolding.

Objectively speaking, the future valuation of Coinbase is mainly based on the answers to four propositions.

Can Coinbase dominate the US crypto market infrastructure building? Second, is Coinbase not just an exchange? Thirdly, will the "crypto economy" become an important part of the real economy? Fourth, will the prices of Bitcoin and Ethereum continue to rise?

These four propositions imply almost the entire narrative of Coinbase.

Can Coinbase dominate the infrastructure building of the US crypto market? From the current situation, Binance and others are still strong opponents in terms of trading volume and scale. However, a key difference in the crypto field is trust - users need to have confidence in the security of their assets and the compliance of exchanges. Binance and others have too much difficulty in expanding their business in the US, and have entangled "grievances" with the SEC, while Coinbase is strictly supervised by the CFTC, SEC, United Kingdom, and European financial regulatory agencies. In contrast, Coinbase should be the preferred place for individuals and institutions seeking safe investment in Bitcoin.

Secondly, Coinbase is not just an exchange. In the traditional US financial system, institutions often play different roles in various links. Companies such as Robinhood, TD Ameritrade, and Schwab have retail brokerage businesses, State Street and BNY Mellon have asset custody businesses, PayPal, Visa, and Mastercard have payment businesses, while NYSE and Nasdaq have stock trading businesses.

The current crypto financial system is obviously not like this. Coinbase already has retail brokerage business, custody solutions, and exchange business, and is a leading player in the crypto payment field. It can be said that it is the "crypto NYSE + Robinhood + State Street + PayPal".

Thirdly, will the "crypto economy" become an important part of the real economy? There is a great deal of market disagreement on this point. All mature real economy markets that have stood the test of time - such as agricultural products, oil, and gas - have flourished because the entire industry profits by selling basic commodities to consumers. The oil market is not just about people speculating on oil prices - it is the physical business of upstream and downstream producers in the energy industry; the corn market is not just about people speculating on corn prices - farmers and large institutions are also trading and hedging risks in order to provide stable food prices to consumers. And what about the crypto market? What are the real business participants?

Currently, few people actually use Bitcoin as a payment method, and mainstream Cryptocurrency is almost impossible to use as a daily payment method. Wider use and circulation still require the final approval of the Bitcoin spot ETF in the US, which will expand the effective "commercial use" of the crypto market, such as allowing individuals and institutions to hold Bitcoin. The crypto economy is expected to continue to exist as a speculative method and emerging asset class, but the difficulty of commercial viability is still very high.

Fourth, will the prices of Bitcoin and Ethereum continue to rise? Coinbase charges fees based on the value of assets traded or held by customers on its platform, and it also holds a large amount of Bitcoin on its own Balance Sheet. Therefore, the rise in cryptocurrency prices does have a direct boost to its market value. From past events, inflation has always existed, fiscal and monetary stimulus has never stopped, and the two main choices for safe-haven assets - gold and Bitcoin - are becoming a greater consensus.

Although the crypto industry is full of challenges, it also means that the remaining players can benefit more. Coinbase is one of the few exchanges that can truly attract institutional investors to enter the field. In the long run, it is expected to perform better than Crypto itself.

MSTR: A better choice than BTC

The US SEC has long delayed making formal decisions on multiple Bitcoin spot ETF proposals, which is disappointing news for the vast majority of investors. However, for investors familiar with MicroStrategy and Bitcoin, this will only enhance the attractiveness of MSTR, as it is currently the most convenient way to obtain Bitcoin through US stock accounts.

MSTR is one of the largest Bitcoin Listed Company holders in the world, thanks to its August 2020 strategy of using excess cash and debt and equity stake financing to buy Bitcoin for a long, sustained period.

According to its Q2 2023 financial report, as of July 31st, MSTR held 152,800 bitcoins with a total cost of $4.53 billion, which is $29,672 per bitcoin. Among them, 15,731 were pledged as collateral for the company's guaranteed notes in 2028, and the remaining 137,069 (about 90% of the total holdings) were not pledged.

Since the launch of the buy-and-hold strategy for Bitcoin three years ago, the MSTR stock price has shown a strong correlation with the Bitcoin price. As shown in the figure below:

For investors who hope to profit from the rise in BTC prices, MSTR is not the only choice. The stock prices of Bitcoin mining companies such as Marathon Digital and Riot Platforms, as well as cryptocurrency exchanges such as Coinbase, also fluctuate in sync with the price of Bitcoin. However, unlike these stocks, MSTR has a fundamental core business, which is a strong competitive advantage.

Core Business Stability Limits Downside Risks

MSTR is also a SaaS company that has been providing enterprise analysis software and services for decades. It has a solid customer base, including Hilton Hotels and Sony, and its annual revenue is quite predictable - 499 million USD in 2022, 511 million USD in 2021, 481 million USD in 2020, and 486 million USD in 2019. Analysts expect revenue of 501 million USD in 2023.

MSTR is migrating its enterprise analytics software customers to the cloud, which will shift from generating revenue through product licensing to generating revenue through subscriptions. So far, the subscription model has been proven successful with a high renewal rate. The customer renewal rate in Q2 2023 was 93% and remained above 90% for the sixth consecutive quarter.

In order to keep up with technological trends, MSTR's core enterprise analytics platform is also exploring the combination with AI. MSTR is expanding its partnership with Microsoft to integrate its analytics capabilities with Azure OpenAI services and Microsoft 365. MSTR is also seeking greater innovation through MicroStrategy Lightning, aiming to leverage the Bitcoin network to achieve new e-commerce use cases and address cyber security challenges.

Although these measures are almost impossible to bring explosive revenue growth, they are a reliable sign of the healthy development of MSTR's core business, which means that it has the ability to continuously provide sufficient cash to cover operating costs. This limits the Downside Risk of its stock price.

From a valuation perspective, compared to other software companies, MSTR's current stock price is reasonable; the difference is that MSTR is not an ordinary software company, and it also has over 137,000 unsecured bitcoins. This makes its stock price more likely to outperform the performance of many tech giants and SaaS peers.

The main advantages of obtaining low-cost capital

For investors who are optimistic about BTC, another main reason to choose MSTR is its ability to raise funds on attractive terms. It is reported that the company's outstanding debt and convertible notes are $2.20 billion, with a weighted average interest rate of about 1.6%. Compared with the average interest rate of 2.1% at the end of 2022, the annualized interest expense has decreased by more than $15 million.

Being able to use low-interest debt to continuously purchase BTC is a wise move. With the improvement of the crypto market in the coming quarters (catalytic events include the approval of the Bitcoin spot ETF by the US SEC, the halving of Bitcoin in 2024Q2, and the possibility of interest rate declines during inflation), the capital appreciation of Bitcoin will exceed the cost of debt and interest.

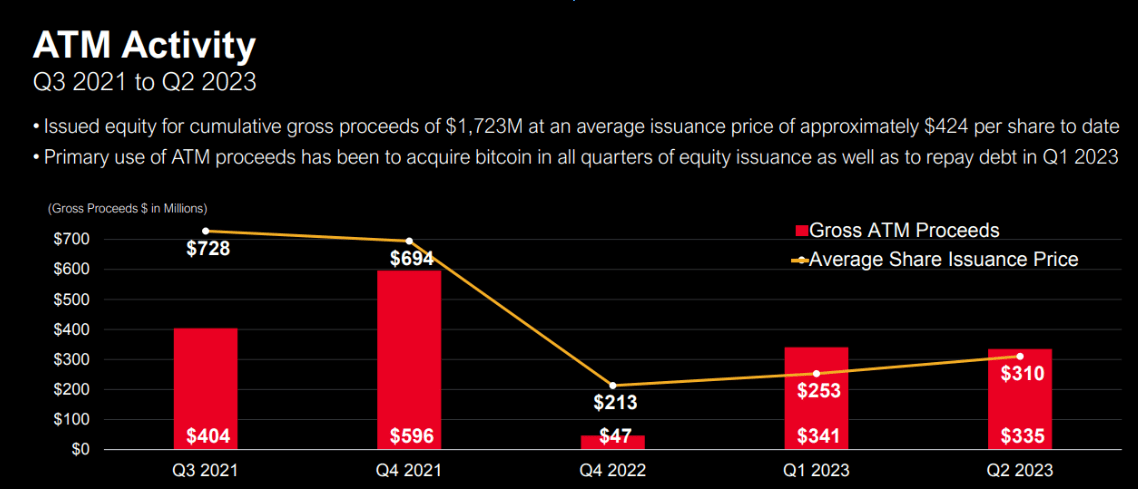

Publish new shares to raise funds is another financing method for MSTR. Since Q3 2021, MSTR has raised a total of $1.70 billion through the ATM program, and the average price of additional shares issued is about $424/share. The main purpose of raising funds is naturally to buy more bitcoins.

MSTR's ATM program is unique in that it has a very low increase in outstanding shares compared to other participants in the Bitcoin space who regularly issue new shares for financing, such as MARA and RIOT.

MSTR's total outstanding shares increased from 11.30 million shares in 2021 to 14.10 million shares in the most recent quarter. In contrast, MARA's outstanding shares jumped from 102.70 million shares in 2021 to 174.20 million shares in the most recent quarter, while RIOT's outstanding shares increased from 117.30 million shares in 2021 to 185.30 million shares in the most recent quarter.

The slow growth rate of the number of stocks means that MSTR has more room to publish more new stocks for financing in the future. In addition, MSTR sold a total of 403,362 shares on September 24th, with a net profit of $147.30 million, which was used to buy Bitcoin.

Risk factors

It is necessary to point out that there are two latent risks to MSTR. Firstly, in the future, regardless of the reason for disposing of part or all of Bitcoin, it may lead to excessive negative reactions from investors. Therefore, the company must continue to bear debt and issue additional stocks to maintain its Bitcoin strategy. However, it is also difficult to guarantee that it can raise funds on attractive terms in the long term, especially if the Bitcoin price continues to stagnate (or worse, plummet). It should be noted that during the last crypto bear market in 2022, many crypto companies went bankrupt due to excessive leverage.

The second latent risk lies in company valuation. Although investors can use Price-To-Earnings Ratio to understand its value as a software company, according to GAAP accounting requirements, the Bitcoin held by MSTR needs to be recognized for impairment every quarter when the Fair Value changes, so the company may frequently incur impairment charges in its financial report. Due to the excessive volatility of Bitcoin prices in the short term (such as $24 million impairment charge in 2023 Q2 and $918 million in 2022 Q2), the already difficult company valuation has become more complicated.

MARA: Is mining a good business?

Marathon is a Bitcoin mining company that provides investors with indirect Bitcoin investment solutions. There is a strong positive correlation between the stock price of mining companies and the price of Bitcoin. Generally speaking, mining companies are actually a leverage game for Crypto.

From historical data, when the price of Bitcoin rises, the stock prices of mining companies will rise more because investors are extremely excited and believe that there is a multiplier effect here; when the price of Bitcoin falls, miners will be hit harder.

The essence of mining business is arbitrage. Rather than saying that mining companies need to study the technical details of Bitcoin, it is better to say that they need to learn from the experience of "mining farms" and operate energy arbitrage business as efficiently as possible. The leading mining companies are often excited about new cooling methods, new architecture methods, new transformers, or new energy arbitrage strategies.

Arbitrage is crucial, which is one of the differentiating factors that distinguish mining companies from their competitors. The best mining companies need to have the best equipment assets and the lowest production costs. More importantly, they need someone who understands energy arbitrage and an excellent CFO.

They sometimes shut down the machines because they can make greater profits through energy recovery plans. The importance of an experienced CFO is that he can guide mining companies through the cyclical bear market and "crypto winter" of Bitcoin.

Marathon's Q23 financial report released on August 8th revealed its business development status: revenue increased by 228.5% year-on-year, with a net loss of $21.30 million (nearly 200% higher than Q1's $7.20 million). This means that the production cost of Bitcoin is high, the market price is not ideal, and other operating expenses such as energy costs are too heavy.

Although it did not meet expectations, MARA's performance still showed significant growth compared to the previous year. Bitcoin production increased by 314% year-on-year, averaging 32 coins per day, but the average price of Bitcoin decreased by 14%, affecting revenue.

The reason for the increase in production is that MARA's operating computing power increased by 54% compared to Quarter 1 in the second quarter, reaching a historic high of 17.7 EH/s. After the second quarter, operating computing power continued to rise, reaching about 19 EH/s in July.

The path to profitability for mining companies is more difficult than that of exchanges and asset management companies. In addition to the common regulatory resistance in the crypto field, as Bitcoin is the main source of income, its price fluctuations often seriously affect the profits and cash flow of mining companies.

In addition, the next Bitcoin halving is expected to occur in April 2024. With the halving of Bitcoin block rewards, mining companies' revenue may decrease. The Bitcoin halving will also increase the difficulty of mining, forcing mining companies to purchase more powerful hardware. More powerful hardware, in turn, will lead to higher energy costs and more operating expenses, which are difficult problems for mining companies to avoid.

Therefore, compared to exchanges and asset management businesses, mining is a riskier crypto investment.

Final thoughts

The crypto industry itself has gone through multiple hype cycles, each driven by speculation about innovation triggers. These cycles have brought more attention, users, and capital to the crypto ecosystem, and expanded the possibilities of crypto technology on top of the progress made by predecessors.

At present, the industry may have reached the point where there are enough puzzle pieces - which can be rematched in different ways to meet broader needs and real use cases - to take the industry to a new place.

During this process, even if you are not in the crypto industry, you can still support the companies you are optimistic about through investment. Here are the top crypto companies and crypto strategy ETFs currently selected by the RockFlow investment research team in the US stock market.

Your investment choices are essentially a vote for the world you want.