Highlight:

ARK Ark Fund currently holds nearly $800 million worth of Tesla stock, making Tesla the largest holding of its ARKK Fund. This indicates that Mu Jie's confidence in its future remains unchanged, and she believes that Tesla's return to the throne is only a matter of time.

Tesla's significant market value fluctuations in history are closely related to the official launch of its strategic products. However, the substantial progress of new businesses (autonomous driving, leasing cars, etc.) is not clear at present. In addition, the recovery of delivery growth in 2024 is far away, and there is a lot of pressure to return to the upward cycle. With the delay of cheaper models and the inability of Cybertruck to make meaningful contributions to performance growth in the short term due to production capacity factors, Tesla is betting too much on the unprepared FSD and the yet-to-be-launched Robotaxi robot taxi business.

“I do see a path for Tesla to one day become the most valuable company in the world. I believe this is not an easy path, in fact, it is very difficult, but it is now possible, and I did not envision it before.”

This is a sentence that Musk repeatedly mentioned during Tesla's earnings call last quarter. He previously stated that Tesla's market value may exceed the sum of Apple and Saudi Aramco in the next five years.

But the reality is not satisfactory. Since the last financial report, Tesla's stock price has fallen by more than 20%. Its decline in 2024 is close to 40%, and the latest market value has fallen below $500 billion. In addition, the company is also undergoing a global layoff of no less than 10%, and several executives have chosen to leave.

During the turbulence, Cathie Wood, a well-known fund manager who has long favored growth stocks, chose to believe in Tesla and frequently increased her holdings.

According to the disclosure of ARK Ark Fund, Tesla has once again become the largest holding of its flagship fund, ARKK, with a scale of nearly 10 billion. It currently holds $727 million worth of Tesla stocks, accounting for 9.85% of ARKK's weight (very close to the default limit of 10% for single shareholding), exceeding Coinbase's weight of 9.11%. This indicates that Sister Mu's confidence in Tesla's future remains unchanged, and she believes that Tesla's return to the throne is only a matter of time.

If you want to learn about the recent performance of ARK Ark Fund, you can follow RockFlow's recently launched "ARK Ark Fund ETF". Scan the code to track the daily performance of each ETF with one click.

Will Tesla leave the ranks of tech giants? When will it regain its glory? The RockFlow research team has conducted in-depth research on its stock price fluctuation history, the reasons for its poor performance in the past year, and the recent controversies related to Model 2 and Robotaxi. We believe that Tesla's business has enough resilience. Although the stock price has been sluggish due to industry cycle fluctuations for a period of time, it is still full of hope.

In addition, the RockFlow investment research team has recently launched in-depth investment research articles on topics such as AI, Duolingo, Adobe, and US stock companies.

The driving force behind Tesla's stock price rise

Looking back, Tesla's major market value fluctuations have been closely related to the official launch of its strategic products.

2013-2016: Tesla is a luxury car manufacturer based on the high-end market with high-priced Model S and X. Similar to brands such as BMW and Mercedes-Benz, Tesla focuses on fashion, high-end electric cars and SUVs during this period. At that time, Tesla's market value was only about $30 billion.

In 2017, the launch of Model 3 to the mass market in July 2017 drove Tesla's first significant increase in market value. By demonstrating its ability to produce affordable mid-range electric vehicles, the market believes that Tesla has the potential to disrupt the broader electric vehicle market.

In early 2020, the mid-size Model Y SUV was launched in March 2020. This more affordable electric SUV expanded Tesla's addressable market size, pushing its market value to $400 billion for the second time, far exceeding Toyota's $200 billion at the time.

Mid-2020: In September 2020, the launch of fully autonomous driving (FSD) testing and robot taxi plans helped Tesla's market value rise significantly for the third time to $800 billion at the end of 2020. Thanks to the further expansion of the total addressable market, investment banks such as Morgan Stanley are very optimistic about Tesla's development prospects.

But then, FSD did not land as soon as possible, and at that time, the market value of the ride-sharing giant Uber was only $600-100 billion, which made the market realize that these two new businesses alone could not maintain a $400 billion increase. Tesla's market value ushered in a relatively obvious short-term correction.

In October 2021, US car rental giant Hertz announced 100,000 Tesla car orders. As soon as the news came out, Tesla's stock price soared sharply on the same day, and its market value also exceeded $1 trillion.

At this time, Tesla was in high spirits, and the bright prospects of electric vehicles, energy business, autonomous driving, and robot taxis all looked quite attractive. However, the subsequent reality shattered investors' good hopes, and Tesla's stock price experienced a year-long correction until the beginning of 2023 when it rebounded.

Currently, the dilemma in 2024 is only a continuation of the unfavorable rebound in performance in 2023. After all, the substantial boost to performance from autonomous driving, leased cars, and Cybertruck pickup trucks is not clear. In addition, the expected growth rate of car sales in 2024 is still far away, and Tesla is under great pressure to return to the upward cycle.

Why has the past year been consistently sluggish?

Tesla's weak performance is not just a problem of the recent quarter. The financial data of the past few quarters has also been unsatisfactory. What worries the market the most is that Tesla's deliveries in Quarter 1 this year decreased by about 9% year-on-year, lower than expected by 14%. This is the first quarterly sales decline since the epidemic in 2020.

Why is Tesla's Quarter 1 delivery data so unsatisfactory? To be fair, there are three core reasons:

Firstly, this can be attributed to the historic interest rate hike cycle. Car sales are cyclical, and the level of interest rates will directly affect consumers' demand for cars. If interest rate cuts come earlier, the car cycle will recover, and Tesla's performance is expected to see significant improvement.

Secondly, the increasingly tense competitive environment in recent quarters (especially in the Chinese market) has led to a phase of saturation in the electric vehicle market. Given that electric vehicles are still an emerging industry, more public charging infrastructure, cheaper and more diverse vehicle options, and continuous upgrades in cruising range can further stimulate demand (the adoption of Tesla charging standards by multiple automakers is a positive signal).

Finally, some temporary factory closures and maintenance have increased Tesla's short-term production and delivery pressure, and related news has to some extent hit the positive market sentiment.

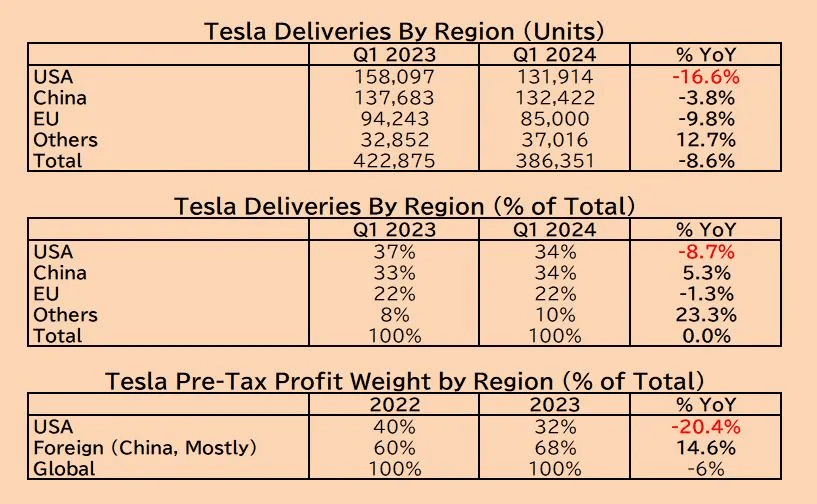

It is worth noting that Tesla's US business seriously dragged down overall deliveries this quarter. The following chart shows Tesla's quarterly delivery data by region, with the largest proportion of the US market experiencing the largest year-on-year decline.

As the US accounted for 32% of global pre-tax profits last year, RockFlow's research team expects this to have a huge impact on the upcoming Quarter 1 earnings.

But to be fair, electric vehicles are facing an industry-wide dilemma, and it's not just Tesla that has given a low score. Despite "only" delivering about 387,000 vehicles in 24Q1, Tesla still regained the title of "the world's largest electric vehicle manufacturer" - it had previously lost to BYD, but this quarter, the latter's delivery volume decreased even more, reaching 42%.

In addition to the year-on-year decrease in deliveries, Tesla also revealed to the market that its car sales growth in 2024 will also be "significantly lower" than in 2023, indicating that the recovery of sales is far away. In addition, another thorny problem it faces is the continuous decline in profit margins caused by price cuts.

Tesla's profit margin has always been ahead of other automakers, mainly due to three factors.

Scale economy (the importance of several super factories to Tesla is self-evident). Bypass distributors and directly face consumers (online and offline direct stores). 3) Low marketing costs (Tesla's advertising budget has always been at an extremely low level).

Due to the long-term lack of new models, in order to prioritize sales and growth, Tesla had no choice but to continue to cut prices in the short term to stimulate demand, so the profit margin data is very ugly.

Of course, bulls can assume that Tesla intends to continue to lower prices in order to make it harder for competitors to compete in an environment with higher capital costs. When the unfavorable factors weaken and growth accelerates again, Tesla will gain a larger market share. Moreover, although it is currently accepting lower upfront profits, it will gain more profits in the future through software additional sales (such as FSD fully autonomous driving).

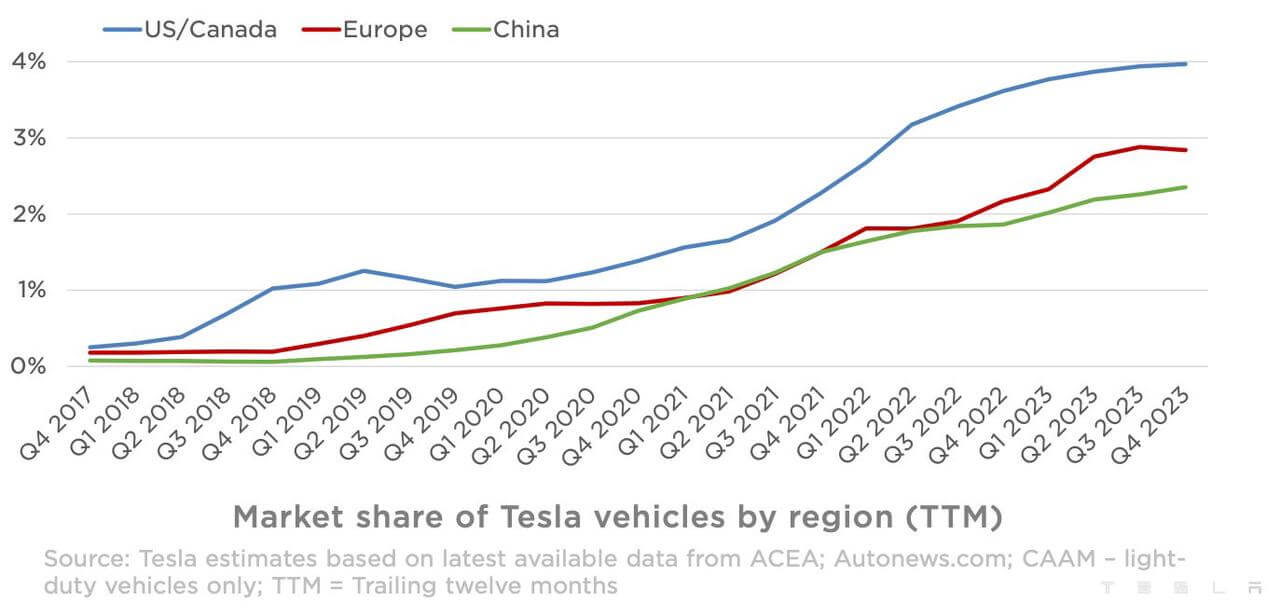

However, the bearish opposition is also very clear: due to the intensification of competition in the entire industry, Tesla's price reduction may lead to a long-term decline in its own profit margin. Especially in Europe and China, other lower-cost companies are catching up, and Tesla's pricing power may weaken in the long term.

The following chart shows the changes in Tesla's market share in the three main regions of North America, Europe, and China over the past six years. Obviously, its market share growth has become very slow in recent quarters.

Overall, in terms of market share and profitability, Tesla is still the leader in the electric vehicle field. The relatively solid fundamentals have not changed in 2023.

When will Tesla return to the throne?

Recently, a Reuters report caused a stir in Tesla's stock price, stating that Tesla is abandoning its $25,000 economy car (Model 2).

Considering that this low-cost electric vehicle is highly anticipated and the market has to some extent incorporated its profit growth expectations, as soon as the news came out, Tesla's stock was sold off, and the stock price fell nearly 6% at one point.

30 minutes later, Musk tweeted that "Reuters lied again", which helped to recover some of the losses, and Tesla's stock price rose in response. However, it still fell 3.6% at the close of the day.

49 minutes later, Musk tweeted again, "Tesla Robotaxi will officially debut on August 8th."

This news caused the stock price to rise by 3.8% after hours, and fans were greatly encouraged. However, it also raised doubts among some investors.

Firstly, if Reuters really publishes rumors, will Musk urge Tesla's legal team to threaten to sue? Second, if the Robotaxi is ready to debut, why not announce it when Tesla's stock price fell to a dangerous low in mid-March, instead of waiting for Reuters to release the new car abortion plan?

One possibility is that Musk was shocked by the negative market reaction to the Reuters news and decided to strike back, so he was not cautious enough to respond beyond the team's original expectations. Obviously, he tried to shift the focus from Tesla's deteriorating automotive business to the company's new positioning of "AI/robotics".

For Musk, this also means that the details of Robotaxi cannot escape the questioning of analysts during the new quarterly earnings call on April 23.

Reuters' report on Tesla canceling the Model 2 comes from multiple sources, most of which are suppliers. Given that parts suppliers for new car models need to participate in research and development about 2 to 3 years before the new car is launched, it can be imagined that this news has a high degree of authenticity.

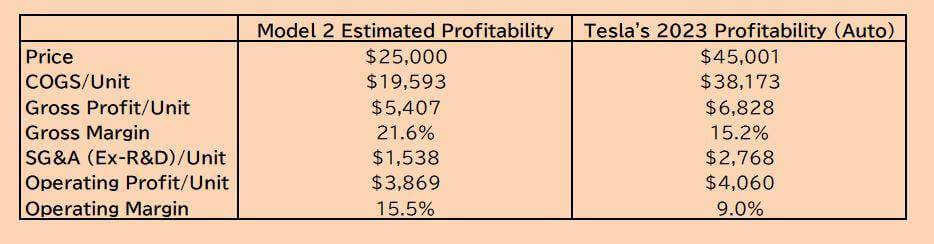

On the other hand, why does the market attach so much importance to the low-cost Model 2? Because it is crucial to solving Tesla's urgent need to boost the profit margin of its automotive business.

The following chart shows the estimated comprehensive data of the expected price, cost, and profit of Model 2 vs. Tesla's existing models.

The above data reveals three key points:

First, the Model 2 is expected to be priced at $25,000, with an expected annual sales volume of more than 500,000 vehicles and an expected gross profit margin of 22%. Secondly, through innovative manufacturing processes, Model 2 production costs are expected to be 50% lower than Model 3 and Y. Thirdly, it is expected that selling 500,000 Model 2 vehicles per year will bring a gross profit of $2.70 billion. This means that although the profitability of Tesla's existing old product line has significantly decreased, the overall profitability will be greatly improved due to the Model 2.

Obviously, this is quite important for Tesla, which has not launched a Volkswagen model for many years.

In hindsight, it may have been a mistake for Tesla to prioritize the launch of the Cybertruck instead of focusing on the next generation of cheaper Volkswagen cars. Bringing the Cybertruck to market is cool, but the market space for this model is not large enough, and due to production capacity factors (expected to produce 250,000 vehicles per year), it cannot make a meaningful contribution to Tesla's performance growth in the short term.

And all of this has ultimately led Tesla to bet too much on FSD, which is not yet fully prepared, and Robotaxi, which has not yet been released.

We believe that if the stories of FSD and Robotaxi are confirmed, Tesla is expected to benefit from car sales and regular ride-hailing revenue streams, and even generate profits similar to "subscription-based software". This is why Cathie Wood believes that Tesla is carrying out the world's largest artificial intelligence project through autonomous driving. The entire ecosystem of robot taxis may indeed create trillions of dollars in revenue, and Tesla, as a platform supplier, will be the biggest winner.

When will such a future arrive? What kind of surprises will Robotaxi bring to the market? Let's wait and see.