Highlight:

Since taking over as CEO of Starbucks in 2018, Brian Niccol has led the company's stock price to rise by 800% in six years, which can be called a miracle in the US stock market. On the day he agreed to become CEO of Starbucks, the latter's stock price soared nearly 25% (market value growth exceeded $20 billion).

As a global coffee giant, Starbucks has fallen out of favor in the US stock market in the past year or two, and multiple operational indicators (such as revenue growth rate) are not optimistic. The early high-speed revenue growth no longer exists, but the current profit margin is quite strong.

Starbucks is facing a serious midlife crisis. The root of all problems in recent years is "digitalization for success and digitalization for failure". Although the revenue scale is still huge, it has lost the "grand narrative" that investors can believe in. In order to find such a "narrative", it needs a visionary leader who also understands the various challenges of catering operations.

Niccol's resume shows his outstanding achievements in the catering industry. He has led the large-scale transformation of Mexican barbecue and successfully transformed it into a rapidly rising fast food empire. The next few months will be a critical period for him to adapt to his new role and start leading Starbucks towards another future.

Introduction:

Over the past six years, a shining new star in the catering industry has sparked heated discussions in the US stock market. The restaurant is called Chipotle (Mexican-style barbecue), and its CEO has led the company's stock price to rise by 800% in six years since taking over in 2018. During the same period, only nine S & P 500 index constituent stocks performed better than Chipotle.

On September 9th, Brian Niccol, the soul figure who helped Chipotle achieve its catering miracle, officially took office as Starbucks' fourth CEO in two years. On the day of the announcement, Starbucks' stock price soared nearly 25% (market value increased by more than $20 billion), and the stock price has not fallen in the past month. The market believes that Brian Niccol is expected to help Starbucks reverse the headwind of the company's development in the past three years and return to the upward cycle. But will this be the case?

RockFlow's investment research team will review the difficulties and crises surrounding Starbucks in the past few years, and analyze the possibility of new CEO Brian Niccol leading Starbucks back to growth based on his previous resume and achievements.

RockFlow will continue to track the subsequent development and latest market trends of high-quality companies in the US stock market. If you want to have a detailed understanding of the development overview, investment value, and risk factors of related companies, you can check out multiple in-depth sorting and analysis articles previously published by RockFlow:

- Riding the wave of weight loss drugs, why did HIMS increase by 250% in one year?

- Chip king TSMC, where will it go after a trillion-dollar market value?

- Tesla's Hopes and Worries

1. What's wrong with Starbucks?

Starbucks was founded in Seattle in 1971 as a coffee bean wholesaler and later transformed into a coffee chain by Howard Schultz. To Italians' surprise, a US company redefined espresso around the world.

In the early days, Starbucks provided a "third space" by opening more and more stores. In recent years, it has followed the new trend of online ordering, self-pickup/takeout delivery, strengthened its membership system and reward activities, and provided comprehensive services to consumers.

However, in the past year or two, Starbucks has not only fallen out of favor in the US stock market, but its stock price has always been in a volatile market. Its business model has also been threatened, and multiple operational indicators (such as revenue growth rate) are not optimistic.

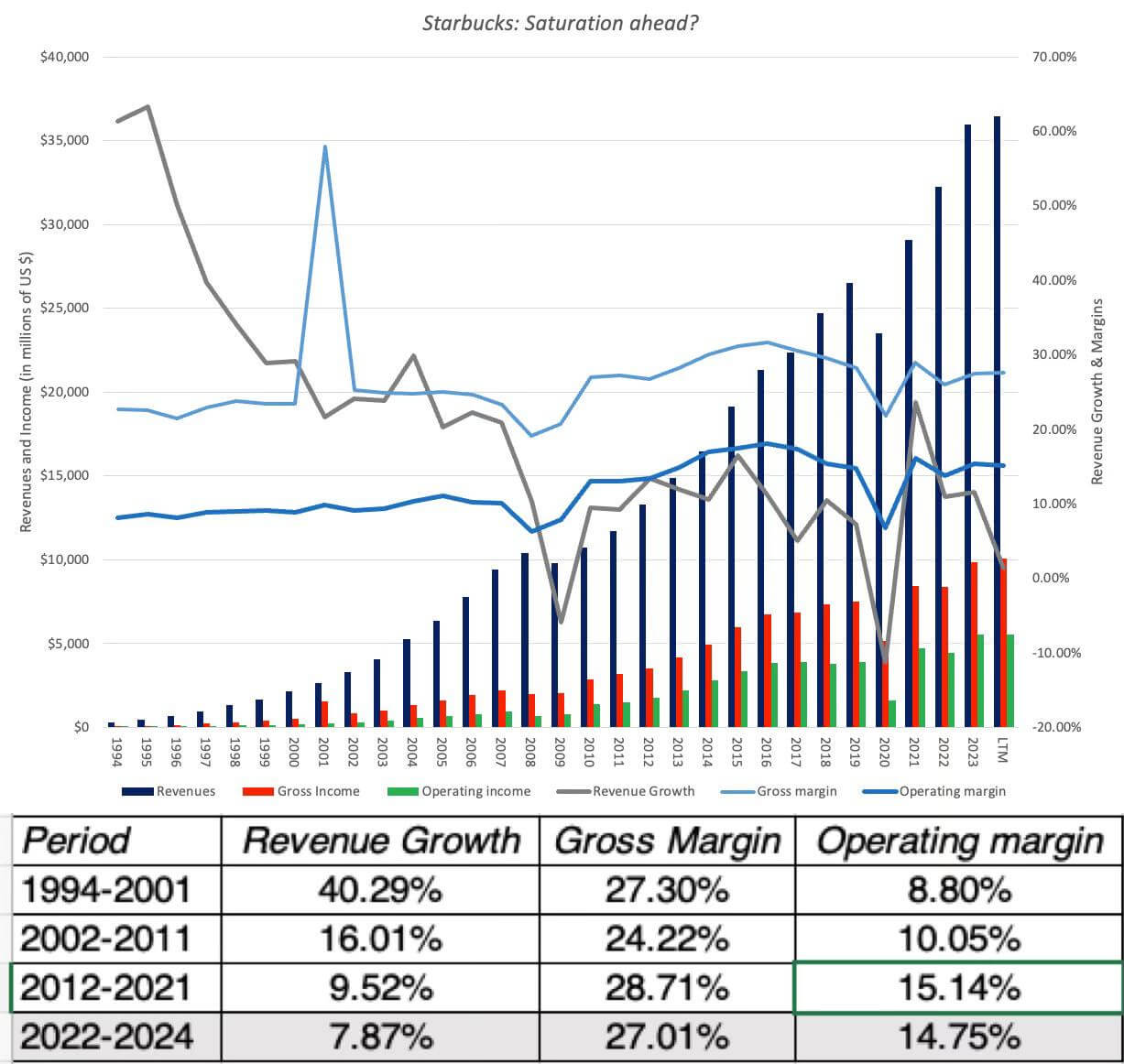

The following chart reflects the changes in Starbucks' revenue, profit, and corresponding growth rates over the past 30 years. Obviously, the early high-speed revenue growth in recent years no longer exists (the gray line represents the revenue growth rate, which is expected to be below 0% in 2024).

It is worth noting that although Starbucks' revenue growth has gradually slowed down over time (even started to decline), its profit margin has improved and is much higher than the first two decades after the company was founded (around 1994).

The main reason for the improvement in profitability is that the company has become cautious about opening stores, at least in the US, and the sales of each store are continuously increasing. The shift to online ordering and self-pickup/takeout delivery has accelerated this trend, as the revenue proportion of the latter increases, the effective radiation range of individual stores increases, and the necessity of expanding the number of stores begins to decrease.

So, why is the current market worried about Starbucks' stock price and future development?

This is a photo of Howard Schultz traveling to Italy in 1983. After returning to the US, he turned Starbucks into the world's first true coffee chain.

Schultz saw during his travels that cafes are a part of Italians' social life. People visit cafes at any time, and cafes are not restaurants for them, but important places for relaxed chatting and socializing. This is an irreplaceable experience. In Schultz's mind, coffee is the medium, and experience is what people pay for. Starbucks conquered the world with the experience of the "third space".

However, today, the Starbucks concept that Schultz has instilled in the market for decades - that coffee shops are gathering places for friends and real-world friends - is collapsing, and the reason is precisely because Starbucks has made some progress in developing its online ordering business in recent years. The current revenue scale of Starbucks is still huge and quite profitable. But it is (or has) lost the "grand narrative" that investors can believe in.

Not to mention, its future revenue growth and foundation are both at risk.

Some investors used to believe that the company's revenue could return to double-digit growth, and the only way to achieve this goal was for Starbucks to achieve greater success in emerging markets such as China and India. However, Starbucks has difficulty competing with local low-priced competitors (such as Luckin Coffee) in China, and the development of its joint venture with India's Tata Group has not been smooth.

At the same time, with the continuous rise in product and employee costs, Starbucks' entire range of products has always been expensive, and Emerging Markets customers are unwilling to pay for it. Even the most loyal customers in Mature Markets (North America, etc.) have begun to reduce their consumption.

In order to find a new "narrative", Starbucks needs a visionary leader who understands the various challenges of restaurant management. As the former leader of Taco Bell and Chipotle, Brian Niccol clearly understands restaurant management well enough, but can he further prove his vision and decision-making ability?

Currently, the market has considerable trust in him. The skyrocketing stock price after the news was announced and there has been almost no pullback, which proves that the market is very much looking forward to Niccol's new measures. However, before we delve into his abilities, it is necessary to clarify what kind of situation he is currently facing at Starbucks.

2. The former CEO's short tenure and thorny challenges

Many companies often lose their souls after a visionary founder retires and appoints a management CEO, and Starbucks is no exception. After Schultz stepped down as CEO in 2000, he twice came back to solve problems and hire new leaders, but it was clear that the new CEO was not the right candidate.

Niccol took over as Laxman Narasimhan for a very short term, taking over Starbucks in March 2023 for just over a year. During Narasimhan's tenure, several quarterly financial reports exposed many problems at Starbucks.

1) Sales decline: The company's sales declined for the first time in the 24Q1 quarter, with store traffic counting down 3% from the previous year.

2) Poor stock performance: During Narasimhan's tenure, Starbucks' stock price fell by more than 20%, indicating investors' concerns about the company's development direction.

3) Growth is facing difficulties: Starbucks' two main markets, the US and China, have both experienced sales declines, indicating that the company's global strategy is facing challenges.

4) Tense labor relations: The tense relationship between Starbucks management and the union continues to cause trouble.

5) Decline in service quality: The uneven service quality of Starbucks US stores has become a growing concern for customers and investors.

Guess what countermeasures he proposed to solve these problems?

Increase investment in membership system construction and loyalty programs, expand new categories and menus, reduce indoor seating in coffee shops, and increase promotional efforts.

Subsequent events have proven that these are completely useless.

Perhaps it's not Narasimhan's fault, he just tried to increase revenue and coffee sales as much as possible, find more ways to persuade consumers to pay, and ignored the enthusiasm of Starbucks loyal customers.

In fact, the root cause of all Starbucks' problems in recent years is "digitalization for success and digitalization for failure".

According to its Q2 financial report, the coffee giant's North American trading volume decreased by 6%, international comparable sales decreased by 7%, and same-store sales in China plummeted by 14%. The previous Q1 report was also very bad, with global same-store sales decreasing by 4% YoY and store traffic counting decreasing by 6% YoY (China is the second largest market after the US, with same-store sales decreasing by 11%). Its predicted revenue growth this year did not actually happen.

Why are fewer and fewer people going to Starbucks? Narasimhan attributes it to the weak economy. This does make sense, as other restaurant chains (such as McDonald's, KFC, Pizza Hut, etc.) have also reported a year-on-year decline in same-store sales.

In response to poor performance, Schultz recently posted a post on LinkedIn criticizing Starbucks management and offering some ideas on how to turn the situation around.

This post caught the attention of Starbucks fans and pointed out the real problem it has had in the past few years - the success of its digital strategy has gradually shifted the company's focus to transactions rather than experiences.

Starbucks used to be a community center where people could hang out. The interior decoration was beautiful, the baristas interacted warmly with customers, and it justified high prices by providing decent products and a comfortable environment. However, currently in the US, 31% of sales are completed through mobile orders. Mobile applications have changed the way customers interact with the Starbucks brand, and have had obvious negative consequences.

The shift towards mobile orders and buy-and-go means that offline store atmosphere is no longer as important. Customers care about "how fast I can get out" rather than "how long they can enjoy their time here". In other words, the increasing digitization of the business is slowly eroding the soul of the Starbucks brand.

What's even more ironic is that everyone is eager to place orders online for convenience, and the crowded orders have led to long offline waiting times, further exacerbating the deterioration of the in-store experience. The barista's job has also changed from a "quasi-craftsman" to an assembly line worker like McDonald's.

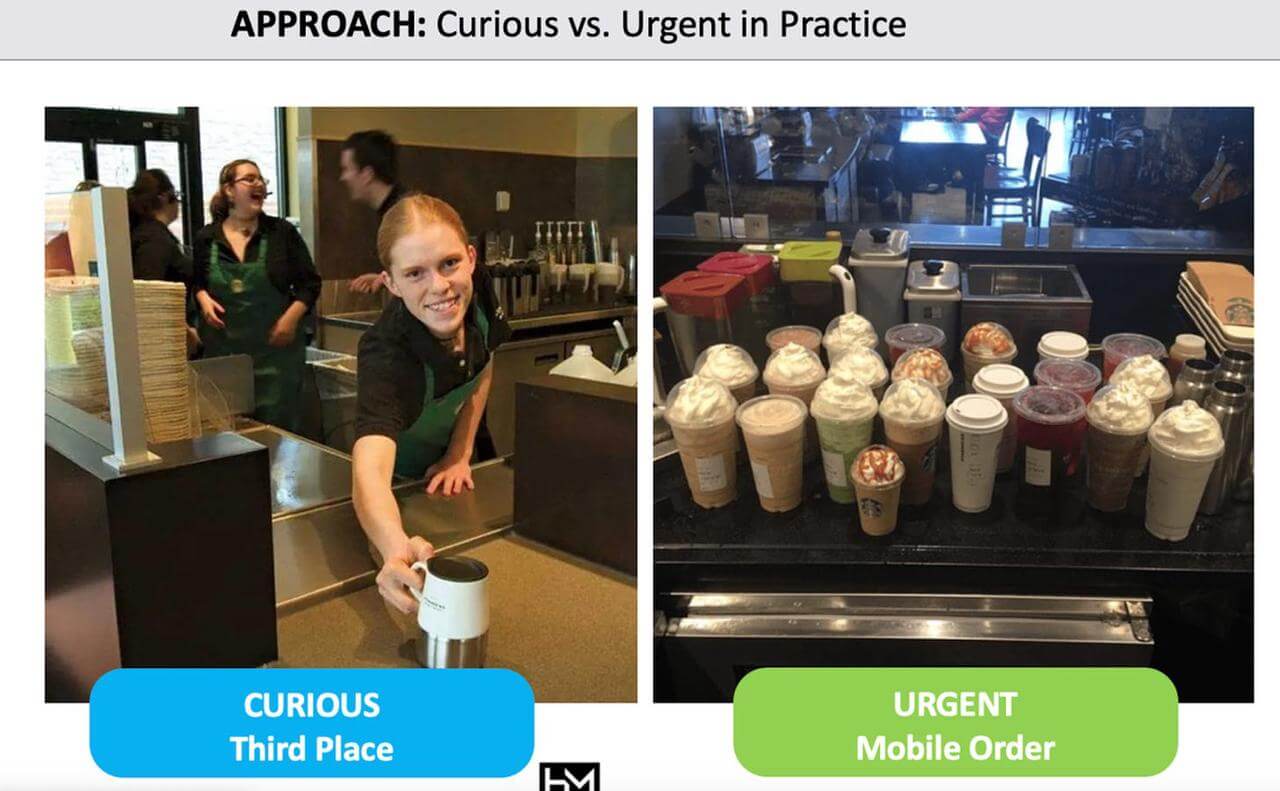

Digitalization has obviously changed Starbucks' DNA, and the following image perfectly captures this change:

Starbucks has shifted from "selling experiences" to "selling products". So it is now in a dilemma.

3. The strength and potential of Starbucks' new CEO

Niccol's resume shows that he has made outstanding contributions in the catering industry.

He joined the Procter & Gamble brand department in the mid-1990s and participated in the Scope mouthwash business of Procter & Gamble in his first job after graduating from college. Because he entered the role quickly, his promotion path was very smooth, and he grew all the way to become the marketing director, vice president, and chief marketing officer of Pizza Hut and Taco Bell under Yum! Brands, and planned many well-known activities (such as "Live Más").

Niccol's tenure at Chipotle is particularly noteworthy. In 2018, when he took over as CEO of Chipotle, the fast food chain was struggling due to an E. coli epidemic, hospitalizing 20 customers. In addition, Chipotle's reputation was also severely damaged due to insufficient attention to food safety and excessive promotion.

Niccol led the company to change its focus, abandon promotions, and invest a lot of resources to expand its menu and business hours. Under his leadership, Chipotle successively launched highly acclaimed new products such as cauliflower rice and fried corn cakes, and increased the number of stores from 2,400 when he joined to 3,400 (including entering the Canadian market). Since becoming Chipotle CEO in 2018, he has led the Mexican restaurant to achieve a large-scale transformation and successfully transformed into a rapidly rising fast food empire.

Niccol is currently facing a series of complex challenges when joining Starbucks, including but not limited to:

Reverse the trend of declining sales. One of Niccol's main tasks is to revive Starbucks' revenue growth. This may involve updating product lists, improving Operational Efficiency, and enhancing overall customer experience.

Improve the online order system. With the increasing importance of digitalization, Niccol needs to enhance the functionality of the Starbucks mobile application, simplify the in-store pickup process for online orders, and reduce store congestion caused by the influx of online orders.

Handle labor relations. Starbucks' unionization work will require Niccol to do the following: establish a more collaborative approach with employees, address concerns about working conditions and benefits, balance employee needs with Company Finance goals.

Balance price and value. In an era of increasing price-sensitivity, Niccol needs to find ways to maintain profitability without alienating customers, ensure that Starbucks' core customer base recognizes its value, and prove the rationality of high prices through quality and experience.

Revitalizing global market strategy. Faced with challenges from the US and Chinese markets, Niccol needs to develop targeted strategies for major international markets, address specific issues faced by Starbucks in China, discover new growth opportunities and emerging markets.

Coordinate the goals of radical investors. Niccol needs to balance the needs of radical investors with his own vision for the company's future, which may take the following measures: demonstrating efficiency improvements in Operational Efficiency, conveying clear long-term growth strategies, and achieving significant improvements in financial performance in the short to medium term.

With Brian Niccol at the helm of Starbucks, the company is at a critical moment. The next few months will be a critical period for him to adapt to his new role and begin leading Starbucks towards another future. The market is looking forward to a new chapter for Starbucks.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: