Highlight:

Adobe's first take-off was due to the conversion of a one-time purchase license system to a subscription system. Although the financial data entered a short-term trough of transformation, with the manifestation of the cloud strategy, the company's revenue grew rapidly in the following five years, and the stock price rose more than seven times.

Adobe's current dilemma is that the golden period of revenue growth brought by the rapid growth of subscription users has basically passed, and the growth rate of the most important Digital Media and Experience Cloud has slowed down to 10%. Therefore, it urgently needs the next important growth driver. Adobe has captured an important detail - the integration of AIGC and existing workflows. Firefly is embedded in the product matrix for easy access by users, perfectly meeting the needs of professional designers to use AI-assisted design and improve efficiency, making AIGC integrated into daily workflows with zero migration costs. Sora may be "commoditized" like Dallas-E, but Adobe has the entire content supply chain from generation to editing. This supply chain is closely tied to professionals and customer groups, and most monetization opportunities lie here.

Adobe was initially seen as one of the biggest beneficiaries of the AI revolution, but due to increased competition and market concerns that AI's contribution is lower than expected, its stock price has recently experienced some pullback.

With the stock price falling back to the low point of October 2023, investors are now wondering whether AI is beneficial or harmful for Adobe.

This article will analyze Adobe's development overview, current situation, AI practices, and recent threats from Sora. The RockFlow research team believes that AI will greatly reduce the time-consuming steps in creative design and significantly improve productivity. Companies in related fields will have the motivation to invest in AI in the long term. Given Adobe's pricing power for a long time to come, AI will become another catalyst for Adobe's stock price after local deployment to the cloud.

In the long run, Adobe in the creative field and Duolingo in the education field are both high-quality targets benefiting from AI.

Adobe's cloud strategy brings the first golden five years

As a leading company in the global creative software field, although there are individual competitors (such as Figma), no one can provide such a wide product ecosystem (from video and image editing to drawing and 3D, and now AI image generation and enhancement) as Adobe. It describes its value proposition as follows: "Our products and services help unleash creativity, improve work productivity, and provide power for the long-term development of digital businesses."

Adobe has three main lines of business: Digital Media (including Creative Cloud and Document Cloud), Digital Experience (including Experience Cloud), and Publishing and Advertising. The first two are key areas, while Publishing and Advertising are traditional businesses that contribute very little.

Among them, digital media mainly includes creative software (Creative Cloud) and document applications (Document Cloud), such as PDF reading editors Acrobat, Firefly, Photoshop, etc.; digital experience mainly provides one-stop services for data collection, analysis, and marketing management for B-end customers.

The key data for both businesses is ARR (annual recurring revenue). Adobe's various products are currently subscription-based, which can provide predictable and stable revenue. This is an important reason why its stock price soared from $70 to $500 from 2015 to 2020.

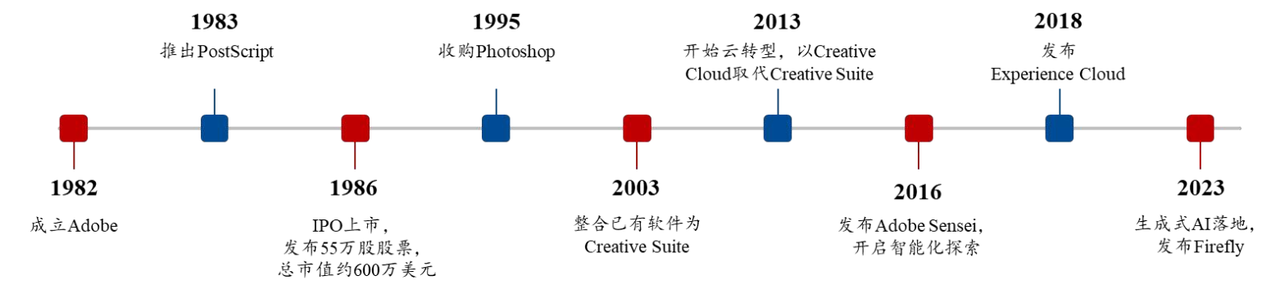

Adobe started with the printing programming language PostScript, and its development process mainly includes three key nodes.

2003: Transition from a single product to a product matrix

Adobe launched the printing programming language PostScript in 1983, which solved the pain point of incompatibility between personal computers and printing devices in the printing market at that time and quickly became the standard in the printing industry. Based on this, Adobe extended graphic layout to vector design, launched Illustrator, and acquired Photoshop as an add-on to provide users with photo editing tools.

With the sharp increase in market share of Illustrator and Photoshop, Adobe saw the market space for content generation software and successively launched video editing software Premiere, special effects compositing software After Effects, and typesetting software InDesign. In 2003, all products were bundled as Creative Suite for sale.

2013: Shift from licenses to SaaS

Against the backdrop of the 2008 financial crisis, Adobe's revenue and profits were under pressure, and its stock price plummeted by 50% that year. The management began to consider changing its business model. Originally, it was a one-time buyout licensing system, which had drawbacks such as high sales costs, slow customer growth, and unpredictable revenue.

After painful reflection, Adobe officially announced in 2013 that all applications could only be subscribed to, replacing the original Creative Suite with Creative Cloud. The financial data entered a transitional low point in the following two years. Until 2015, the effect of cloudification strategy became apparent, driving the company's revenue into a period of rapid growth in the following five years.

- 2016: Shift from increasing the number of users to improving the level of product intelligence

Adobe started its intelligent layout in 2016 and released the underlying AI tool Adobe Sensei for its products. Currently, it provides hundreds of AI functions for existing products. In March 2023, it also released the AI content generative model Firefly and the customer experience management model Sensei GenAI.

It is currently exploring the benefits that AIGC can bring to the creative industry and hopes to expand its business growth space through this.

As mentioned earlier, Adobe underwent cloud transformation in fiscal year 2013. The revenue growth rate fell into a trough in the following two years, but revenue surged in the following five years, with a CAGR of 21.8%. Since fiscal year 2020, the proportion of subscription revenue has continued to increase and reached over 90%, marking the completion of the cloud transformation.

Currently, Adobe's core dilemma is that the golden period of revenue growth brought by the rapid growth of subscription users has basically passed. Although overall revenue continues to increase, the growth rate of the most important Digital Media and Experience Cloud has slowed down to 10%. Therefore, it urgently needs the next important growth driver.

AI content supply chain strategy wins first battle

In March 2023, Adobe launched Firefly, an AI Text-to-Image model that allows users of different ability levels to generate high-quality images.

According to Google search index, Firefly's traffic has remained stable after the new feature was released, without any significant trough. According to company data, Firefly's cumulative image generation exceeded 2 billion after six months, 3 billion in seven months, and 4.50 billion in eight months. The scale and growth rate of image generation far exceed other Text-to-Image models.

At first, Firefly's market feedback was good, although similar products (such as Dall-E and Midjourney) sparked a price war, and some critics claimed that Firefly did not have an advantage in certain effects. However, Adobe's Firefly strategy still sparked market enthusiasm.

Adobe emphasizes that Firefly takes a differentiated compliance route, training based entirely on licensed Adobe Stock content, publicly licensed content, and publicly expired copyright content, and the generated content can be used for commercial purposes. In addition, it promises to bear the cost of Firefly's infringement claims to further reduce customer risk.

MidJourney and Stable Diffusion have faced multiple copyright disputes, including three artists suing MJ and SD for unauthorized use of their original works to train AI at the end of 2022, and image licensing service Gretty suing SD for including millions of unauthorized artworks in their training data in 2023.

In this context, users (especially enterprise users) will prioritize Firefly, which has less compliance risk, when trying to commercialize generated content. Adobe has a much larger dataset of creative resources available for training than its competitors.

On the other hand, Adobe management has created a new term - content supply chain. It describes the process of conceptualizing, creating, and using digital content as a "supply chain". Adobe has seized an important detail - the integration of AIGC with existing workflows. Firefly is embedded in products such as Photoshop and Illustrator. Users can call Firefly to generate content in the software and further modify it with professional tools, meeting the needs of professional designers to use AI-assisted design and improve efficiency, making AIGC integrated into daily workflows with zero migration cost.

Looking at MidJourney and DALL-E, they both exist in the form of independent websites. The website interface only provides simple modification tools, and even when linked with other editing software, it cannot achieve a complete ecosystem similar to Adobe.

With the implementation of Firefly's charging model of parallel billing and subscription fees on November 1, 2023, it effectively supported the price increase of Creative Cloud products (an average increase of 9%). This price increase has a larger change compared to the 8% increase in 2018 and the 5% increase in 2022, covering more regions and products. It is a rare consecutive year of price increases, which not only reflects the excellent monetization potential of AIGC technology, but also strengthens the certainty of Firefly's revenue growth.

At this point, Adobe's AI content supply chain strategy has achieved initial success. This strategy has been warmly welcomed by investors and was once regarded as a pioneer in AI productization (similar to Microsoft). Its market value will increase by more than $110 billion in 2023.

How big of a threat will Sora pose?

OpenAI launched Sora on February 15th, and the quality of AI-generated videos is amazing, causing Adobe's stock price to plummet. Given that Adobe's two flagship products are photo editor and video editor, investors are concerned that the diffusion model (the basic model of Text-to-Image and Text-to-Video) will seriously damage Adobe's competitive advantage.

This logic is reasonable. It seems that AI is greatly reducing the threshold for content creation and even reducing the workload itself. If AI can complete most of the work, can Adobe continue to maintain its leading position in the creative industry in 10 years?

Not to mention, Sora is obviously no longer Adobe's only competitor. Google and Apple have already provided a large number of AI-supported intelligent editing tools and are still continuously optimizing them. Microsoft is also constantly launching new competitive features through Copilot.

If Adobe used to be a niche giant that could thrive in a relatively small market, now, with the improvement of AI model capabilities, other giants are focusing on a wide range of similar product development and solutions (especially for daily use cases), and competition in the creative field is becoming increasingly fierce. It can be said that Adobe is facing unprecedented challenges.

In this regard, we need to consider two aspects:

Firstly, returning to the issue of Sora, AIGC is unlikely to provide the final result that the creative industry needs. Sora (or any other model) can generate videos based on text, but it is difficult to become the final product. This difference may be acceptable in the non-professional world, but it is difficult for professionals to recognize it as the final output.

This gap means that creative tools are still irreplaceable, as AIGC can only "solve" the first step. This situation has already occurred in the AI Text-to-Image model, and considering that videos are more complex, the gap may be even more obvious.

Therefore, Sora may be "commoditized" like Dallas-E, but remember that Adobe has the entire content supply chain from generation to editing. This supply chain is closely tied to professionals and customer groups, and most monetization opportunities lie here.

At least for now, most of Adobe's competitors offer their tools as an added value. Apple and Google are improving their hardware, operating systems, and related software, but they are not monetizing creative tools as standalone products.

The content supply chain strategy and the successful monetization of Adobe Firefly have made Adobe familiar with the upcoming competition.

On the other hand, Adobe believes that although AI has greatly improved productivity and efficiency, as more content is generated, a larger user base is contributing greater value each time the model is used. Although AI may slow down (or even reduce) the scale of subscription users, part of this "demand decline" will be offset by the higher revenue brought by AI.

Not to mention, Adobe is also actively facing challenges. It successfully acquired AI startup Rephrase.ai in November 2023. The company operates an AI-based video content platform that combines text scripts and user avatars into videos with user images for commercial scenarios such as marketing, customer communication, and holiday greetings. The acquisition of Rephrase.AI means that Adobe has completed its first acquisition in the AI field, reflecting Adobe's active search for potential new tools to complete its product puzzle.

Adobe's last quarter results and current quarter outlook

Adobe's Q3 performance was still good, with revenue and profit exceeding expectations. Revenue increased by 11.6% YoY to $5 billion, Net Profit 1.50 billion USD, and profit margin increased by 3.4% YoY and 0.7% QoQ.

Although the growth has slightly accelerated, it is still not too impressive. When discussing the company's prospects for 2024, the management did not set too aggressive targets, only expecting a full-year revenue growth rate of 10.2% and a flat profit margin. This is obviously far lower than the growth rate that Adobe investors are accustomed to before 2022.

In contrast, another AI giant, Microsoft, accelerated its revenue growth to 17.6% in the three months ending in December, and AI products made quantifiable and substantial contributions to its revenue.

The market expects Adobe's fourth quarter revenue to reach $5.145 billion, a year-on-year increase of 10.53%; earnings per share will reach $3.37, a year-on-year increase of 24.52%.

This time, the market focus is on Adobe's growth momentum and AIGC's integration into its product suite. Adobe has already introduced AI into its product matrix, including the Firefly model in Creative Cloud and AI services in Experience Cloud, but whether it can monetize Firefly in a meaningful way remains to be seen. The market wants to understand how these AI services can actually translate into customer engagement and financial performance.

On the other hand, Adobe has already officially announced the termination of the acquisition of Figma. This means that although Adobe has saved $20 billion in expenses, it may harm future growth expectations. It needs to work hard to create a product that competes with Figma to curb the latter. It is difficult to say whether this has had a positive impact on Adobe.

Conclusion

Will the AI wave benefit or harm Adobe's business? If Dall-E is the first attempt, it is obvious that the market overestimated the threat in the short term. After all, after Dall-E was launched, Adobe quickly launched Firefly and retained the entire Value Chain.

The RockFlow team still believes in Adobe's pricing power and the value that Firefly will bring over time. We believe that Adobe will continue to benefit from AI and consolidate its long-term market position.