Highlight:

The high performance expectations of the financial report and the lack of "willingness to protect the market" by the management team have suppressed the short-term confidence of the Pinduoduo bulls. However, Duan Yongping chose an advanced strategy of bottom fishing, "starting to put selling points".

Buffett and Duan Yongping are both proficient in using option strategies. The classic case of the former is his investment in Coca-Cola, while the latter has repeatedly practiced similar strategies in the technology sector, and both bottom fishing Pinduoduo and Alibaba have achieved considerable profits.

Options can express more diverse investment perspectives. Reasonable use of option tools not only reduces risk levels, but also provides a source of high annualized returns.

RockFlow's "Dip Sniper" ① product, based on the Sell Put strategy, helps users obtain Fixed Income in market fluctuations while preparing for low-priced positions.

On Monday, Pinduoduo fell nearly 30% overnight, the largest drop since its IPO, as lower-than-expected performance and warnings from company executives dented market confidence.

Goldman Sachs believes that the main reasons for this big drop are due to three aspects.

Before the financial report was released, the market had high expectations. Due to strong expected performance, Pinduoduo's stock price has risen by about 20% since the end of July, while the KWEB (China Overseas Internet ETF) index has fallen by 4% during the same period.

Pinduoduo's online marketing service growth has shown signs of normalization for the first time, with a year-on-year growth rate slowing to 29%, which is lower than expected. However, to be fair, Pinduoduo's performance is still good and significantly better than Alibaba and Kuaishou e-commerce.

The management's comments scared the market. Pinduoduo's management pointed out in the conference call that due to intensified competition and possible decline in long-term profitability to promote high-quality development, it is expected that future revenue growth will slow down and sacrifice short-term profits. As the overall investment is still in the stage, there will be no buybacks or dividends in the next few years.

With high expectations falling short and management showing no "willingness to protect the market", the short-term confidence of Pinduoduo's bulls was suppressed, and the stock price almost fell below the center of the earth.

Under such an astonishing decline, is it suitable for bottom fishing now? How to bottom fishing?

Duan Yongping released a statement that night, stating that although he did not fully understand Pinduoduo's business model, he was bottom fishing and "starting to put selling points".

RockFlow will continue to share high-quality investment strategies and useful tools for US stocks. If you want to learn more about the basics and advanced guides of US stock investment, you can check out RockFlow's previous articles.

- Chip king TSMC, where will it go after a trillion-dollar market value?

- AI is hot, but not yet a "bubble"

- When will C3.AI return to the uptrend?

- After NVIDIA, who will be the next early AI beneficiary?

1. Buffett and Duan Yongping love the steady bottom fishing strategy

In fact, this is not Duan Yongping's first time bottom fishing Pinduoduo.

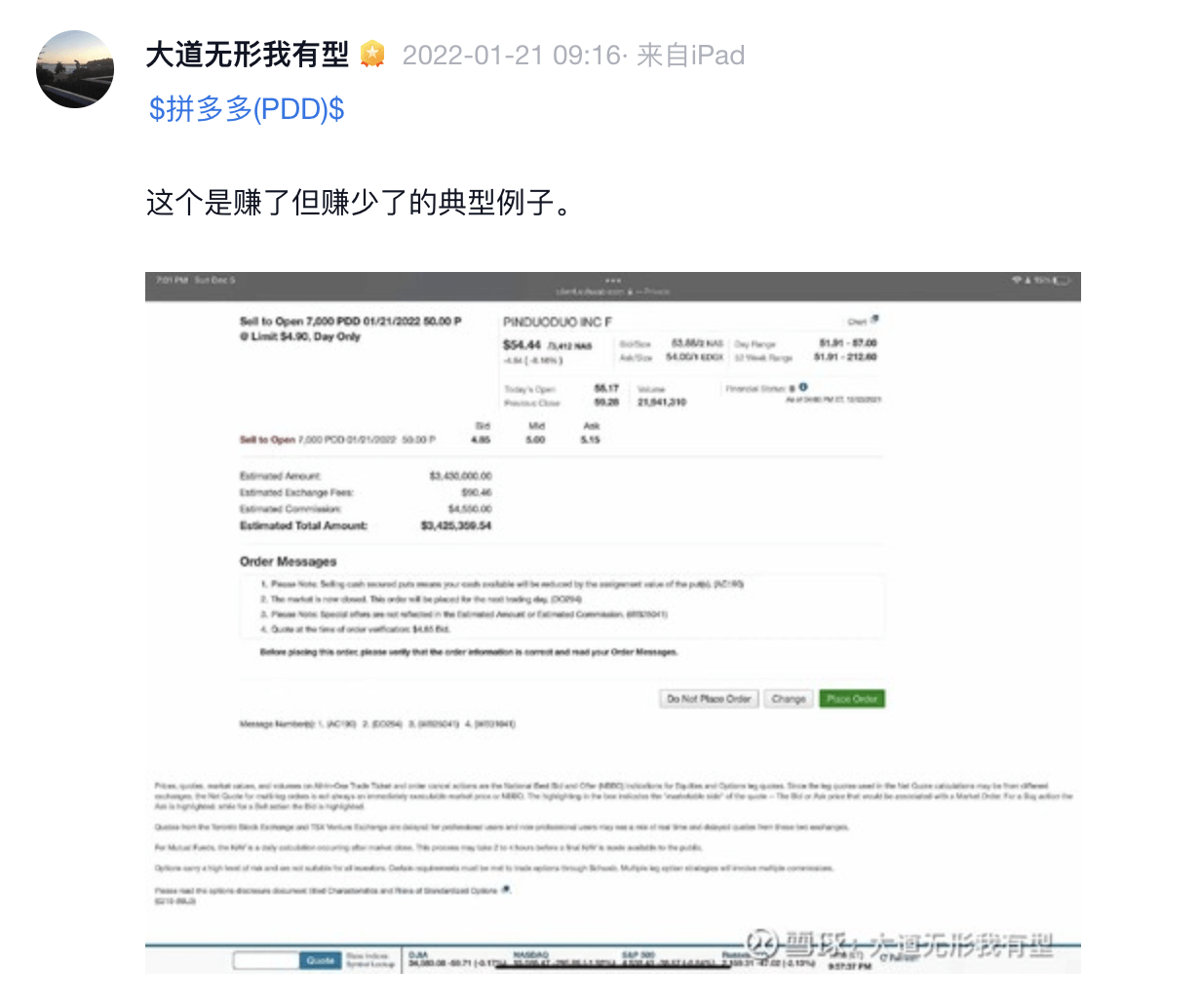

At the end of 2021, Pinduoduo's quarterly report collapsed, and the stock price was nearly halved within a month. Duan Yongping posted a statement saying, "Although I still don't understand their business model, I feel that their support for agricultural products is still very meaningful. I am ready to invest in Pinduoduo again." The specific operation is exactly the same as this time-selling put. At that time, he also attached 7,000 settlement orders for Pinduoduo put options, with a potential transaction amount of about 35 million US dollars.

More than a month later, Pinduoduo's stock price has risen by more than 20% compared to Duan Yongping's bottom fishing. He posted again, "Pinduoduo is a typical example of earning but not earning much."

This bottom fishing, Duan Yongping is obviously continuing to implement the previous investment logic. He is expressing more of an attitude: not fully understanding, but optimistic.

The so-called "selling point put" actually refers to selling put options, that is, the counterparty pays a certain option fee to Duan Yongping, so as to have the right to sell Pinduoduo stocks in the US stock market to Duan Yongping at the agreed price on the agreed date. Simply put, this means that the target is moderately optimistic about the rise.

Duan Yongping's consistent investment principle is Value Investment. Value Investment favors companies and bottom fishing at low prices, which is his strategy. This time, Pinduoduo is no exception.

Before bottom fishing Pinduoduo, Duan Yongping also made a move on Tencent and Alibaba. Duan Yongping's first investment in Tencent was in 2018, with the logic behind it being "a long slope, thick snow". This is also Buffett's famous saying, "Life is like a snowball, the most important thing is to discover wet snow and a long mountain slope".

As the head of the Value Investment faction, Buffett's most famous case for the application of options is undoubtedly Coca-Cola.

On April 2, 1993, Marlboro cigarettes announced a 20% price cut. After the announcement, stock prices, including Coca-Cola, fell one after another, but Buffett believed it was a good stock based on his research and understanding of Coca-Cola.

He thought he could buy 3 million shares of Coca-Cola at about $35 per share and was confident that the price would not fall below that level. So he decided to sell the put option on Coca-Cola.

In April 1993, Buffett sold a put option on 3 million shares of Coca-Cola stock for $1.50 each. The expiration date of the option was December 17, 1993. At Berkshire Hathaway's annual shareholder meeting, Buffett stated that he was prepared to increase 2 million shares in a similar manner.

Buffett's only risk in selling the put option this time is that if Coca-Cola's stock price falls below $33.5 in December, he must buy Coca-Cola stock at $35 per share, but he is not worried because he originally wanted to buy Coca-Cola stock at $35.

As a result, by the end of 1993, with Coca-Cola's stock still above $35, the put buyer abandoned the contract, and Buffett made a net profit of $7.50 million.

Buffett's use of option strategies is quite proficient. He understands that selling put options can steadily harvest THETA, and based on his research and understanding of Coca-Cola, even call-overs after expiration are very cost-effective. It can be seen that Duan Yongping obviously recognizes and has practiced similar investment strategies in the technology stock field many times.

2. Why is it more cost-effective to be an option seller than to buy stocks directly?

Call and Put are respectively bullish and put options in American options. Buying and selling represent different market views.

Selling put options means two possibilities:

If the expiration stock price is higher than the exercise price, the buyer gives up the call-over and the seller earns a net profit from the premium. If it is a small increase and the increase cannot cover the premium, then the ROI rate outperforms buying the stock. If there is a large increase, only the premium can be obtained, and higher returns cannot be obtained, which is equivalent to missing out.

If the expiration stock price is lower than the exercise price, the buyer will call over, and the seller's specific profit and loss depends on the difference between the premium and the price difference. If there is still a surplus after deducting the decline in the premium, the seller will still make a profit; if the decline swallows up the premium, the seller will lose money, but the loss is still relative to the market price of the stock, and the actual purchase of the corresponding stock is still the same.

Therefore, selling put will only result in a big loss when there is a big drop. As long as the stock price does not fall below the range covered by the premium, the seller will never lose money.

Buffett and Duan Yongping, who are well-versed in investment, have repeatedly verified a truth with their decades of investment experience: options have become a very useful tool in Value Investment due to their many advantages.

First of all, Value Investment is a long-term investment based on the fundamentals of a company. Based on a long-term optimistic view of its future, profits are made through long-term holding and short-term volatility selling. Unless held for a long time and not sold, risks are inevitably associated with volatility. With the assistance of option tools, risks can be effectively reduced.

Secondly, options can express more diverse views. Duan Yongping firmly buys Apple in the US stock market, and has repeatedly used the strategy of selling put to express his bullish views on Alibaba and Pinduoduo, rather than directly buying a large amount of stocks.

The reason why Duan Yongping did not directly buy Pinduoduo's stock this time may be because he believed that there was not much room for the stock price to rise, but it has basically bottomed out. Therefore, he sold the put, earned the premium when it rose, and built a position at a low price when it fell. Among them, the application of option tools not only reduces the risk level, but also provides a source of high annualized returns.

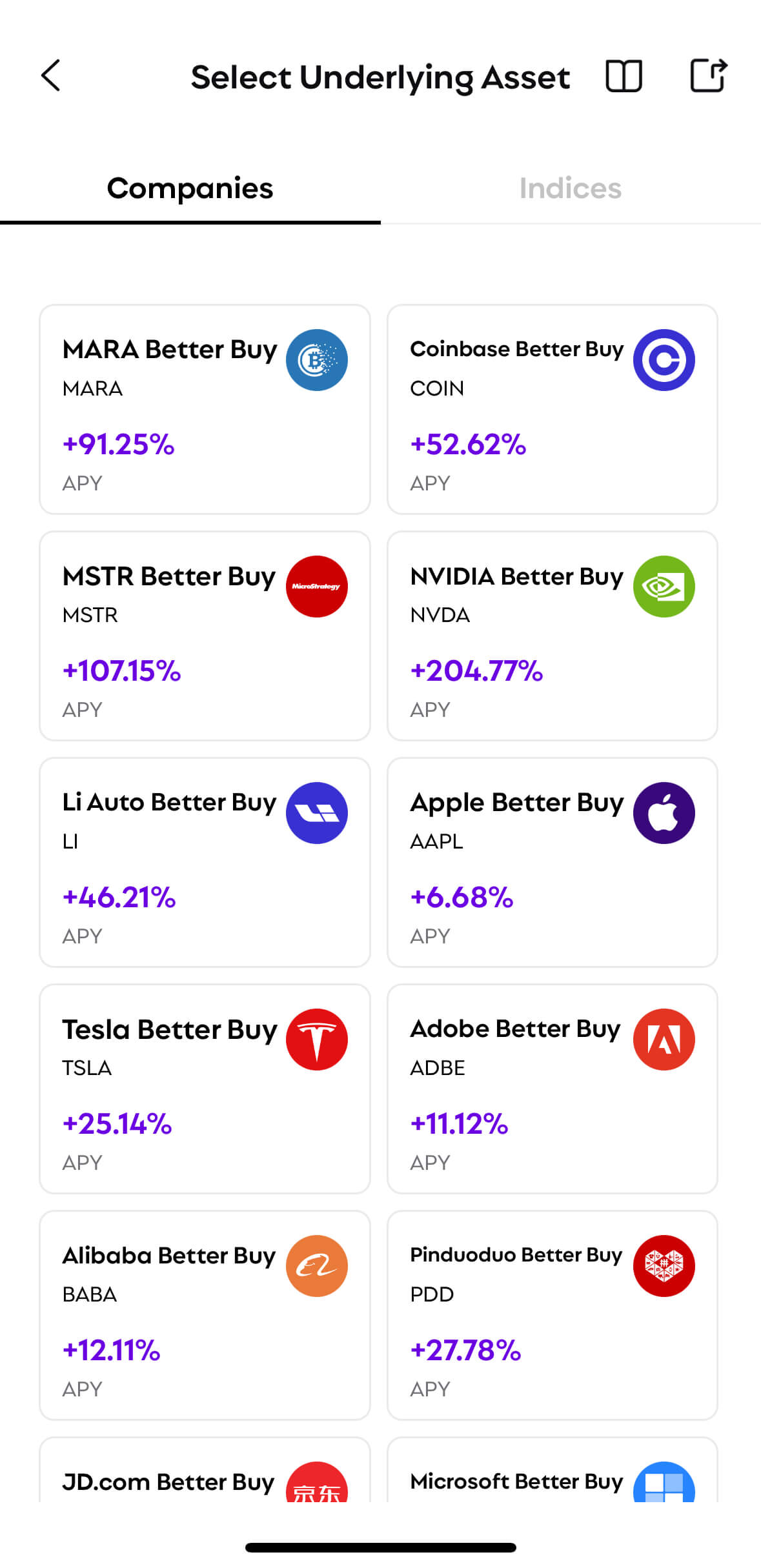

3. A more concise and convenient innovative option financial product - RockFlow "Dip Sniper"

(Copy the link https://mobile.rockflow.ai/zh-Hans/docs/options/better-buy to view the detailed tutorial of RockFlow Dip Sniper)

"Dip Sniper" is an innovative options wealth management product launched by RockFlow. It is based on the Sell Put strategy to help users obtain Fixed Income in market fluctuations and prepare for low-priced positions.

Users can choose a suitable exercise price and expiration date for the "Dip Sniper" product, and receive a premium immediately after the subscription is completed. At the close of the expiration date, if the stock price falls below the exercise price, investors will buy stocks at the exercise price; if the Closing Price does not reach the exercise price, there is no need to buy stocks. Since 100% of the corresponding stock's cash is frozen in the user's account during the subscription, the "Dip Sniper" product will not have any position squaring risk.

Taking Pinduoduo as an example before the opening on Tuesday, when the stock price was 100 dollars, if you buy the "Dip Sniper" product that expires this Friday and has an exercise price of 90 dollars, you can immediately receive a premium of 30% annualized return. This money is Fixed Income, and regardless of how the stock price changes, the premium has already been received.

By the close of this Friday, if the Pinduoduo Closing Price does not fall below 90 dollars, the user's funds will be unfrozen and the transaction will be completed. If it falls below 90 dollars, the user will buy Pinduoduo stock at a price of 90 dollars and complete a low-priced position. The actual purchase price is lower than 90 dollars because they received an annualized premium of 30% at the beginning.

In contrast, ordinary Sell Put requires users to have a certain understanding of option trading, including exercise price, margin requirements, option contracts, etc. RockFlow's "Dip Sniper" product simplifies the trading process, simplifying complex option trading into simple and easy-to-understand financial products. You only need to choose the exercise price and expiration date (usually this Friday or next Friday) to efficiently complete option trading, express your investment ideas, and greatly reduce the participation threshold.

In summary, there are two advantages to Dip Sniper: firstly, it allows users to lock in opportunities to build positions at low prices during market fluctuations, and at the same time, they can obtain a Fixed Income regardless of how the market changes; secondly, it is an ideal choice to achieve stable returns during the financial reporting season and prepare for low-price positions.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: