Highlight:

As a pillar company in the semiconductor industry, TSMC is closely related to the chip and supply chain development relied upon by the entire AI bull market and tech giants. It holds 60% of the global foundry market share and about 90% of the market share at the forefront, effectively occupying a monopoly position.

TSMC's stock price has risen by over 200% since its low point in October last year, making it one of the top ten companies in the world by market value. The management is extremely optimistic about the prospects for 2024, believing that its revenue growth rate will return to the level of the semiconductor boom from 2020 to 2022.

The market value of trillions of dollars is just the starting point. With the surge in demand for AI chips brought by artificial intelligence, TSMC's performance is expected to continue to rise in the long term. As the scale of artificial intelligence applications continues to expand, TSMC remains one of the most core beneficiaries.

Introduction

Few companies outside the US can reach a $1 trillion volume, but TSMC is about to become an exception. Driven by the AI boom and strong chip demand, TSMC's stock price has risen by more than 200% since its low point in October last year, making it one of the top ten companies in the world by market value, with a market value approaching $1 trillion.

How important is TSMC? As one of the pillar companies in the semiconductor industry, it is closely related to the development of the entire AI bull market and the chips and supply chains that tech giants rely on.

Chips are ubiquitous in modern human civilization. From washing machines to smartphones, chips are indispensable. Last year, the number of chips produced by the semiconductor industry exceeded the total number of goods produced by all other industries and companies in human history.

Although in the early days of the semiconductor industry, almost every company owned fabs (semiconductor manufacturing facilities), since then, most companies that focus on designing chips (fabless companies such as NVIDIA) have chosen to outsource chip manufacturing to foundries.

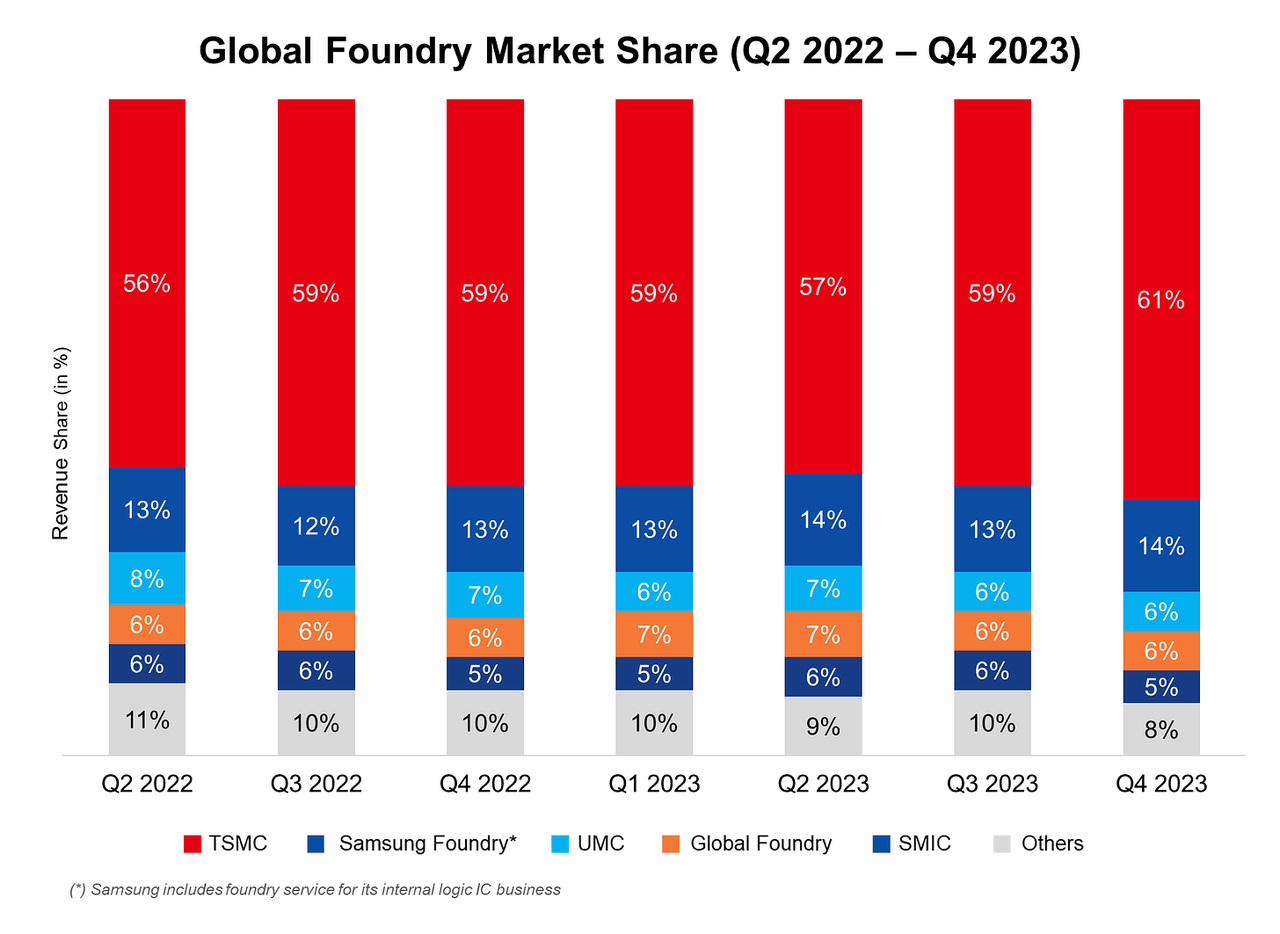

Today, foundries produce the vast majority of the world's chips. TSMC alone accounts for about 60% of the global foundry market (as shown in red in the figure below).

More importantly, TSMC holds about 90% of the market share in cutting-edge nodes (i.e. manufacturing processes that require the smallest size, highest density, and highest precision), effectively occupying a monopoly position. Cutting-edge nodes are crucial for applications that require extremely high computing performance, such as supercomputers, advanced servers, high-end PCs and smartphones, artificial intelligence/Machine Learning, and military/defense systems. Therefore, the importance of TSMC is self-evident.

The RockFlow investment research team will conduct in-depth analysis of the origin, development process, current performance, and financial status of TSMC to help everyone fully understand its investment value.

RockFlow will continue to track the follow-up development of AI concept stocks and the latest market trends. If you want to learn more about the development overview, investment value, and risk factors of related companies, you can check out RockFlow's previous in-depth analysis articles.

- AI is hot, but not yet a "bubble"

- When will C3.AI return to the uptrend?

- After NVIDIA, who will be the next early AI beneficiary?

Starting point - Give full play to the only advantage and focus on pure wafer foundry

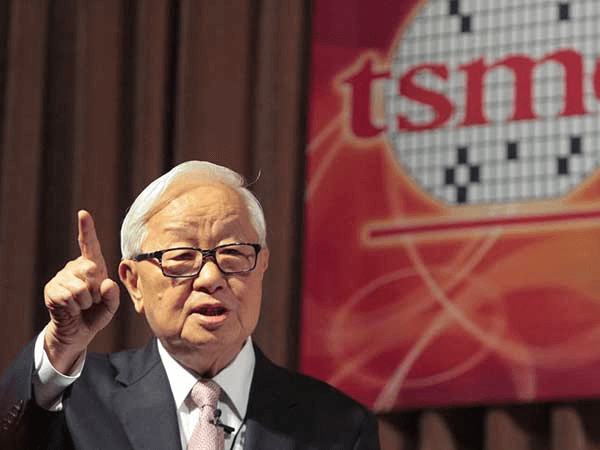

If Steve Jobs is the soul of Apple, then Zhang Zhongmou is the legendary creator of TSMC. Only by understanding his early history with TSMC can we better understand TSMC today.

Zhang Zhongmou is a typical late bloomer. He founded TSMC at the age of 55 and led the company for nearly 20 years before retiring at the age of 74.

However, his retirement life was short-lived, and he returned to lead TSMC in 2009. When he returned, TSMC's market value was $40 billion. By June 2018, at the age of 87, Zhang Zhongmou retired again, and TSMC's market value was close to $200 billion. Today, TSMC's market value is approaching $1 trillion.

Imagine being 55 years old, believing in an unproven business model, and then building a small company into one of the world's most important giants.

Zhang Zhongmou was born in China. When he was young, he left his hometown with his family for Hong Kong due to the Anti-Japanese War. Later, he was admitted to Harvard and moved to the US at the age of 18. In his sophomore year, he transferred to MIT to study mechanical engineering. In the next three years, he completed his undergraduate and master's degrees, and then decided to pursue a doctoral degree at MIT, but failed the exam twice.

In 1955, Zhang Zhongmou started looking for a job. He received two offers: one from Ford with a monthly salary of $479, and the other from Sylvine Electric Products, which was said to have a salary only $1 higher than Ford's. Zhang Zhongmou accepted the latter and started working in Sylvine's newly established semiconductor department.

Due to his background in mechanical engineering, he decided to self-study textbooks in order to quickly master electrical engineering knowledge. While studying the classic works of William Shockley, the father of transistors and a Silicon Valley legend, he appeared at a bar with a textbook and bought drinks for other colleagues so that they could answer the questions in the book.

Zhang Zhongmou eventually left Sylvine, but he did not forget the management's thinking about the company's dilemma at that time: "We (Sylvine) cannot produce what we can sell, nor can we sell what we can produce."

Zhang Zhongmou joined Texas Instruments (TI) in 1958. That same year, Jack Kilby invented the integrated circuit (IC) at TI.

At TI, Zhang Zhongmou's initial project was very challenging. IBM decided to outsource some chip manufacturing to TI because the demand was too high for them to complete alone. In addition, IBM's own factory had a yield rate of only about 10%, which means that for every 100 chips produced, 90 of them had to be discarded.

When Zhang Zhongmou was assigned to the project, TI's yield was almost zero. In just four months, he increased the yield to 20%. TI recognized Zhang Zhongmou's potential and proactively funded him to pursue a PhD at Stanford. This time, Zhang Zhongmou obtained his PhD in just two and a half years.

After graduating with a PhD, Zhang Zhongmou returned to Texas Instruments as the general manager of the semiconductor department. Five years later, he was promoted to vice president and was widely rumored to be a popular candidate for the next CEO.

Although Zhang Zhongmou became a US citizen in 1962, there are rumors that Zhang Zhongmou may not have been appointed CEO of TI because he is of Chinese descent.

After working at TI for nearly 30 years, Zhang Zhongmou switched to General Instruments as COO. 18 months later, he resigned from the position. Almost at the same time, his first marriage also came to an end. As Zhang Zhongmou was struggling with personal and professional challenges, Li Guoding, later known as the "father of Taiwan's economic miracle," invited Zhang Zhongmou to lead the Industrial Technology Research Institute (ITRI) in Taiwan, which was supposed to be a research institution like Bell Labs. Zhang Zhongmou thought this would be where he would retire.

But when Li Guoding gave him a new task, everything changed.

Li Guoding asked Zhang Zhongmou to start a new semiconductor company in Taiwan and make it a global leader.

Although Taiwan was not developed at that time, it was not unfamiliar with the semiconductor industry. At that time, the added value of the role played by Taiwanese companies was very low, with a gross profit margin of about 4-5%. When Zhang Zhongmou formulated the business plan, he realized that the only feasible path for the new company might be pure OEM. Here are Zhang Zhongmou's own thoughts:

When I stopped to think about the task Mr. Li Guoding gave me, an idea came to my mind. Before coming to Taiwan, I had been working in the semiconductor industry for thirty years. I have a close understanding of how fierce the competition in this industry is, and some companies are very excellent - such as Intel and Texas Instruments. Japanese companies are also very powerful. It is very difficult for a new Taiwanese company to make a name for itself.

So I tried to study what we have in Taiwan. My conclusion is that we have very little. There is no advantage in research and development, or very little; there is no advantage in circuit design, IC product design; there is no advantage in sales and marketing; there is almost no advantage in IP.

Taiwan's only possible advantage is semiconductor manufacturing and wafer manufacturing. So, what kind of company should be created to leverage this advantage and avoid all other weaknesses? The answer is pure wafer foundry.

How did TSMC become the pride of Taiwan?

Although Zhang Zhongmou came to this conclusion, it is not easy to implement it. The traditional view at that time was that "any excellent semiconductor company should produce its own chips instead of outsourcing." However, due to the growing demand for chips in the market, integrated equipment manufacturers (IDMs, companies that design and manufacture) are willing to outsource some of their manufacturing needs to foundries.

Despite the "surplus" demand and the many uncertainties in the business model, Taiwan has decided to contribute half of the $220 million needed by Zhang Zhongmou. The other 28% comes from Philips, a well-known Dutch electronics manufacturer that once co-founded the global lithography giant ASM with ASM. The remaining 22% comes from several Taiwanese business leaders, who are basically commissioned by the government to invest.

TSMC was officially established in 1987. At the beginning of its development, it pioneered the controversial "leading cost curve" pricing scheme. The concept of this scheme was to price new chips at a lower profit margin to obtain more production, thereby increasing production and optimizing technical efficiency to obtain higher profit margin orders.

In the first few years, TSMC mainly produced "surplus" orders for IDM, and what really drove its business growth was the trend of the rise of fabless factories. Especially for companies like NVIDIA, Qualcomm, and Broadcom, which were established at the same time as TSMC, but because there were no wafer factories producing their own designed chips, they all hoped to outsource their manufacturing operations.

TSMC has long attached great importance to customer service and support. It has established a dedicated customer support team to work closely with customers, understand their needs, and help optimize chip design. TSMC also provides a range of value-added services, such as packaging and testing, to help customers quickly and efficiently bring products to market.

Another key advantage of TSMC's business model is its focus on contract manufacturing. It does not design or sell its own chips, but simply provides manufacturing services to customers who design and sell chips. This allows TSMC to focus on its core competitiveness in chip manufacturing while providing advanced capacity to customers.

As the number of fabless factories grew from a few to hundreds or thousands, TSMC's revenue continued to grow. TSMC went public in Taiwan in 1994 with a market value of $4 billion. It later went public in the US in 1997.

Later, as TSMC's process nodes became more advanced, their customers could meet and occupy a higher market share, which created greater demand for TSMC's chip manufacturing capabilities. Although it was initially at a significant technological disadvantage, it didn't take long to catch up with its peers and gradually surpassed everyone else within a few years.

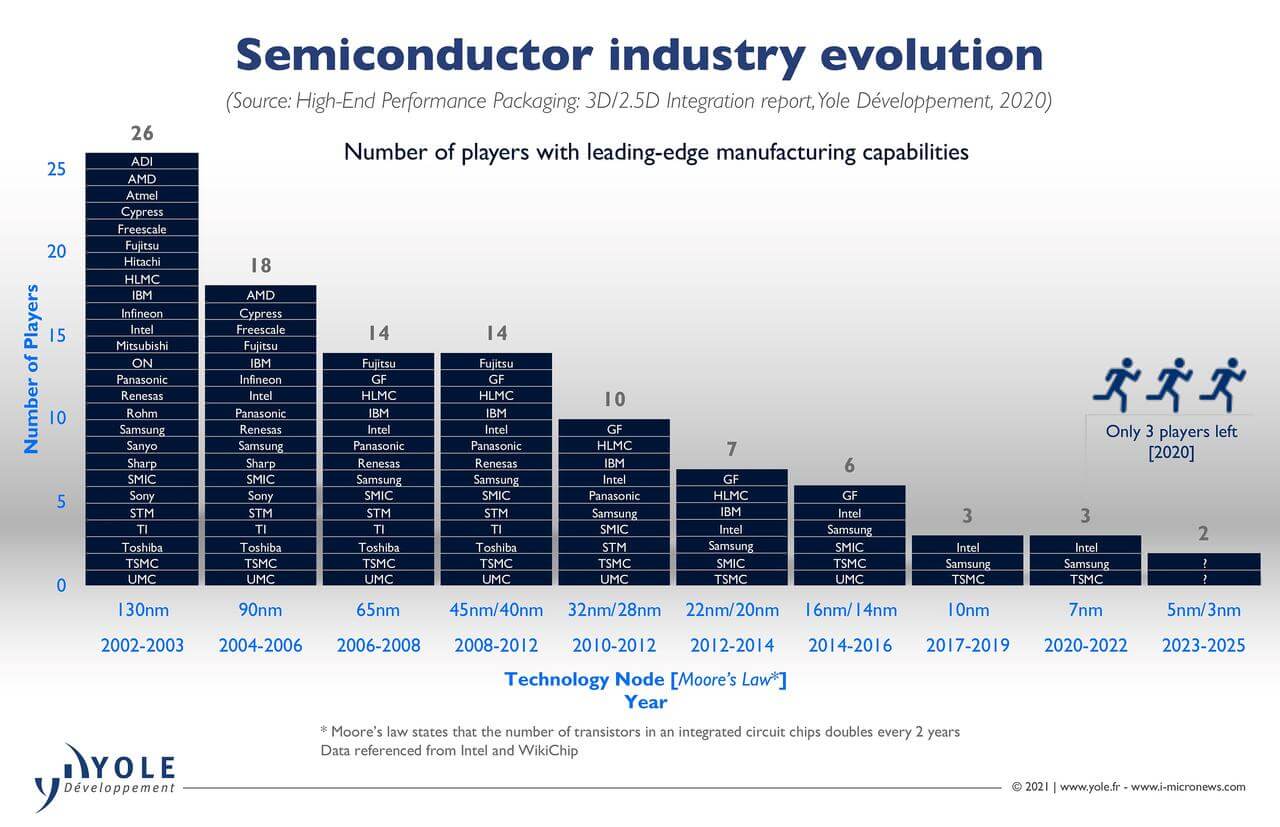

The following chart shows the evolution of the demand for advanced nodes by mainstream companies in the semiconductor industry over different time periods. From 2002 to 2003, 130nm chips were the mainstream, with 26 foundries in the market. Then, on average, every two years, the chip scale decreased, the production process requirements increased, and players were eliminated. During this process, TSMC always mastered the most cutting-edge manufacturing processes.

In 2005, TSMC's revenue was about $8 billion and operating profit was $2.80 billion, and it seemed that the business foundation was quite solid. Zhang Zhongmou was 74 years old at the time and decided to retire and hand over his leadership position to Cai Lixing.

However, it turned out that this retirement was only temporary. In the summer of 2009, 78-year-old Zhang Zhongmou decided to replace Cai Lixing and return to TSMC.

Although the economy was still affected by the global financial crisis at the time, iPhone and smartphones had already emerged in the late 2000s. When competitors hesitated to make large-scale investments in this macro context, Zhang Zhongmou decided to invest actively and distance himself from competitors.

TSMC's cumulative capital expenditure during 2005-2009 was only $12 billion, while during the 2010-2014 period after Zhang Zhongmou returned to TSMC, TSMC's cumulative capital expenditure was as high as $40 billion.

This is also the time when TSMC began to establish a close relationship with Apple. Before the iPhone 6S, Apple would divide manufacturing responsibilities between Samsung and TSMC to achieve supplier diversification. But since then, TSMC has won almost all of Apple's business: iPhone, iPad and Mac. Currently, Apple is TSMC's largest customer, and this company alone will generate about $18 billion in revenue for TSMC in 2023.

Zhang Zhongmou resigned as CEO of TSMC in 2013, but still serves as chairperson. He has been working for the company for 30 years since its establishment and finally left the board of directors in 2018.

Returning to the growth track, TSMC's financial performance is expected to continue to achieve good results

After experiencing the largest cyclical adjustment in more than a decade in 2023, this leading chip foundry is extremely optimistic about the prospects for 2024. The management stated that its revenue growth rate will return to the level of the semiconductor boom period from 2020 to 2022. The revenue and growth rate for the next three years are shown in the following figure.

TSMC's revenue growth in 2024 will be mainly due to its shift to more advanced technologies, especially the emerging growth of industry-leading 3nm chips, and the long-term strong demand for 5nm and 7nm chips in the market (as shown in the purple, green, and blue figures below).

TSMC CEO Wei Zhejia also stated during the 2023 financial report conference call that the company is heavily betting on running the latest N3 node.

Our 3nm technology is the most advanced semiconductor technology in PPA and transistor technology. Therefore, almost all global smartphone and HPC innovators are collaborating with TSMC. N3E further utilizes the solid foundation to expand our N3 series, improving performance, power, and output. N3E has entered mass production in the fourth quarter of 2023.

With strong demand from smartphone and HPC Application Area customers, we expect revenue from 3nm technology to more than double by 2024. As we continue to enhance our strategy for 3nm process technology, we expect strong multi-year customer demand and believe that our 3nm series will become another large and enduring node for TSMC.

Wei Zhejia revealed that after N3, TSMC is also expected to achieve N2 mass production in 2025.

However, due to the growth of N3 business, the company has explained the impact on future profit margins. TSMC's CFO explained:

On the positive side, as the business recovers, we expect the profit margin to increase in 2024. However, as N3's revenue contribution will be much higher than in 2023, we expect the gross profit margin of N3 for the full year of 2024 to be diluted by about 3 to 4 percentage points. Our strategy is expected to achieve higher capital efficiency in the medium to long term, but we need to overcome resistance in the short term. In the long term, we continue to predict a gross profit margin of 53% or higher.

Of course, TSMC also needs to deal with some risks and challenges at present. The first key risk is competition from other semiconductor manufacturers, including contract manufacturers and chip manufacturers that produce their own chips. However, TSMC can maintain its technological advantages for a long time, accumulate solid technology, basically follow "Moore's Law", and launch different nano-level technologies in turn (the latest being 3nm, 2nm, etc.). Whether it is the process or factory construction, it is a step-by-step experience inheritance, and competitors are basically unable to achieve overtaking on the bend.

In addition, the company also needs to manage geopolitical risks, which is the biggest Black Swan. In order to ensure supply chain security, TSMC's strategy is to follow the trend of anti-globalization. It has selected several key countries and regions around the world (such as Arizona in the US, Kumamoto in Japan, Saxony in Germany, etc.) to layout internationalization production capacity. At the same time, in order to maintain technological leadership, TSMC implements the N-1 development strategy, introducing overseas process technology that is one generation lower than Taiwan's local mass production technology, and retaining the most advanced technology in Taiwan Province.

Conclusion

The RockFlow research team believes that as a global leader in the semiconductor industry, TSMC has a stable business model and excellent performance. The company has long been at the forefront of global chip manufacturing technology improvement and innovation, and has won most of the global chip foundry orders with ultra-high yield and the most advanced process.

Currently, TSMC, whose market value is close to one trillion US dollars, is still on the rise. The demand for AI chips brought by artificial intelligence has surged, and its performance is expected to continue to rise in the long term, thus significantly pushing up the company's stock price. As the scale of artificial intelligence applications continues to expand, TSMC is still one of the most core beneficiaries.

About the Author

The RockFlow research team specializes in long-term analysis of high-quality companies in the US stock market, as well as emerging markets in Latin America and Southeast Asia, focusing on industries with high potential such as cryptocurrencies, biotechnology, and more. The core members of the team come from top technology companies and financial institutions including Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, and CITIC Securities. Many of them have graduated from leading universities such as Massachusetts Institute of Technology (MIT), University of California, Berkeley, Nanyang Technological University, Tsinghua University, and Fudan University.

You can also find us on these platforms: