Highlight:

1)C3.AI was created by Tom Siebel, a veteran in the enterprise software field. Initially focused on the energy industry, with the increasing maturity of technology and changes in market demand, C3.AI began to develop AI products, provide AI transformation solutions and services for multiple categories of enterprises. Well-known competitors include Salesforce and Palantir.

2)With the continuous evolution of AI technology and the iteration of large models, its business model is also diversified. Typical representatives of C-end applications include Microsoft Copilot, Notion AI, and Adobe Firefly and Duolingo Max, which have been deeply analyzed by the RockFlow investment research team. As for B-end enterprises and tool platforms, there are Salesforce, Palantir AIP platform, and Unity AI solution Unity Muse, which is also the opportunity that C3.AI hope to seize.

3)Since its IPO in 2020, C3.AI's financial performance has been impressive, with continuous revenue growth and increasing customer base. Although it is not yet profitable, when it starts reporting stable earnings (or related signs), the market will pay more attention to and recognize the company's value.

Introduction

In this wave of AI craze, with the fierce competition between OpenAI, Google, Meta and other tech giants, large models themselves have attracted most of the attention. However, in fact, the landing of AI, the improvement of enterprise processes, and the improvement of efficiency and decision-making ability are also worth looking forward to.

How AI can better leverage the attributes of productivity tools, promote enterprise transformation and profit growth, will attract sustained attention for a long time, and this field is also expected to give birth to new vertical giants. The RockFlow research team believes that, in addition to Palantir, which was previously introduced, C3.AI , which focuses on developing AI applications and services for enterprises, is also a potential target.

In the previous quarter, C3.AI released performance that exceeded expectations, with a year-on-year increase of 85% in the number of customer agreements signed, which pushed the stock price up 24.52% the next day. After Wednesday's trading, C3.AI will release its latest quarterly financial report. Will it bring new surprises to the market this time? This article will analyze C3.AI business overview, competitive advantages, and potential catalysts for stock prices in detail.

In addition, RockFlow's previously launched "AI Rising Star" investment research stock list includes a series of top high-quality companies focused on expanding AI innovation technology and products. Please scan the code to view and track their latest performance.

In addition, RockFlow has previously delved into the development history, current business status, and investment value of multiple high-quality US stock companies. Please click to view.

- How did Faraday Future become a Meme stock? Which will be the next?

- After NVIDIA, who will be the next early AI beneficiary?

- Tesla's Hopes and Worries

What kind of company is C3.AI?

As a relatively important but not well-known company in the AI industry, C3.AI was created by Tom Siebel, a veteran in the enterprise software field. His previous start-up company, Siebel Systems, was acquired by the enterprise service giant Oracle in 2006 and has extensive experience in the SaaS industry. His repeated entrepreneurial experience also laid the foundation for later. When Tom Siebel wanted to embark on the next entrepreneurial journey, C3.AI came into being.

When it was first established in 2009, it was still called C3 Energy. Tom Siebel believed that Big data and AI would have great potential in optimizing energy management and promoting the development of green energy. Therefore, C3 Energy mainly collected and analyzed a large amount of energy data in the early days to help utility companies optimize power distribution and reduce energy waste.

With the increasing maturity of technology and changes in market demand, C3 Energy has gradually expanded its business to other industries such as manufacturing, finance, healthcare, and defense. It has also begun to realize that its platform technology has broad application potential in multiple fields.

So in 2016, it officially changed its name to C3.AI to reflect its business transformation from a single industry solution to a universal AI and Big data platform. Currently, C3.AI focuses on developing AI products, providing AI transformation solutions and services for enterprises, with well-known competitors including Salesforce and Palantir.

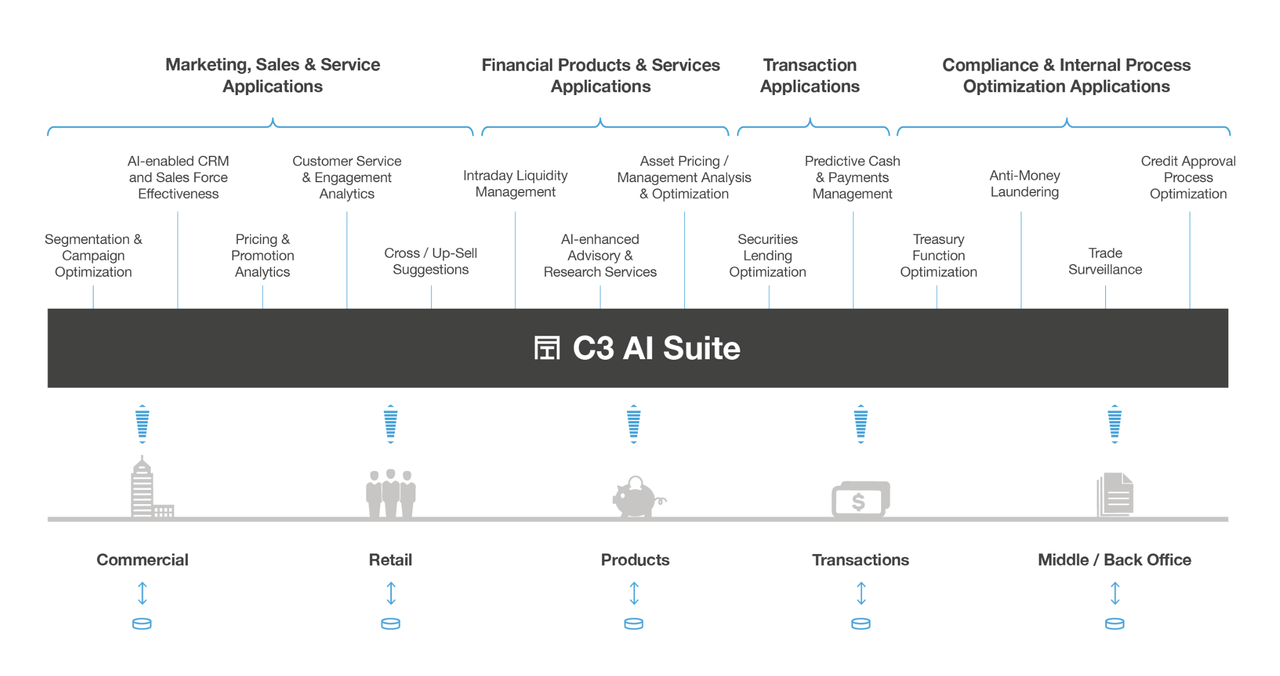

C3 AI Suite is C3.AI's core product. As an integrated platform, it includes modules such as Data Transmission Service, Data Management, AI Modeling, Machine Learning, Predictive Analytics, and Application Development. In addition to this general AI platform, C3.AI also provides a variety of pre-built AI applications to help enterprises quickly achieve specific business needs. These applications cover business scenarios in multiple industries, including but not limited to:

CRM - Helps enterprises optimize Customer Relationship Management, improve sales efficiency and customer satisfaction; Predictive Maintenance - Used for equipment predictive maintenance, predicting equipment failures and taking measures in advance. Energy Management - Helping energy companies optimize energy management and improve energy utilization efficiency. Fraud Detection - used in the financial and insurance industries to identify potential fraudulent behavior by analyzing transaction data.

In terms of revenue composition, 90% of C3.AI's current revenue comes from subscriptions. It provides AI platforms and application services to customers through a subscription model, where customers purchase on demand and pay based on usage. This model ensures the sustainability of revenue streams while providing customers with flexible choices.

The remaining 10% of revenue comes from multiple services and customized solutions it provides. For large enterprises and complex projects, C3.AI provide customized AI solutions. Although this approach takes a long time, it can create significant business value for customers. The company's management expects this part to account for 10-20% of revenue in the long run.

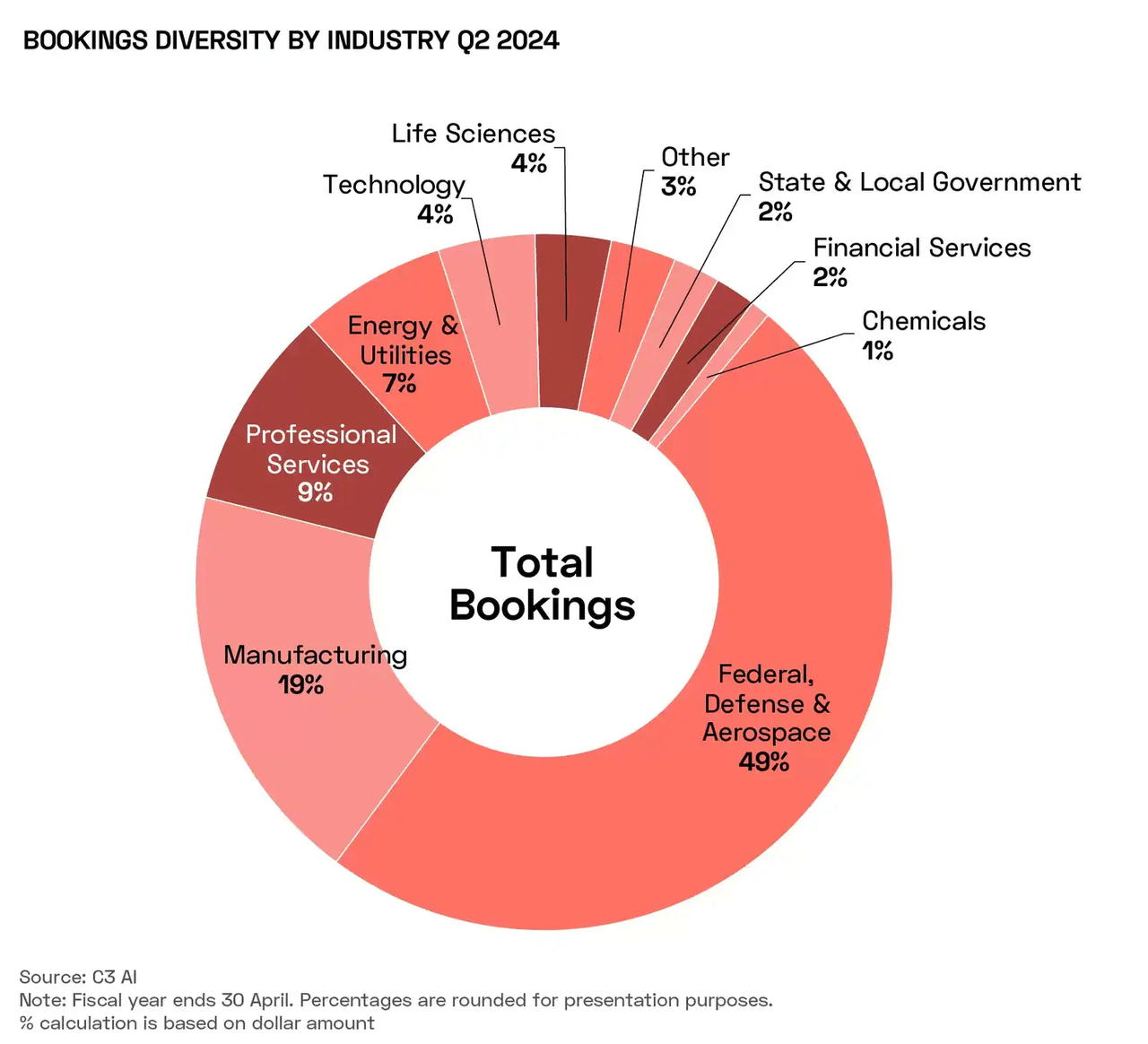

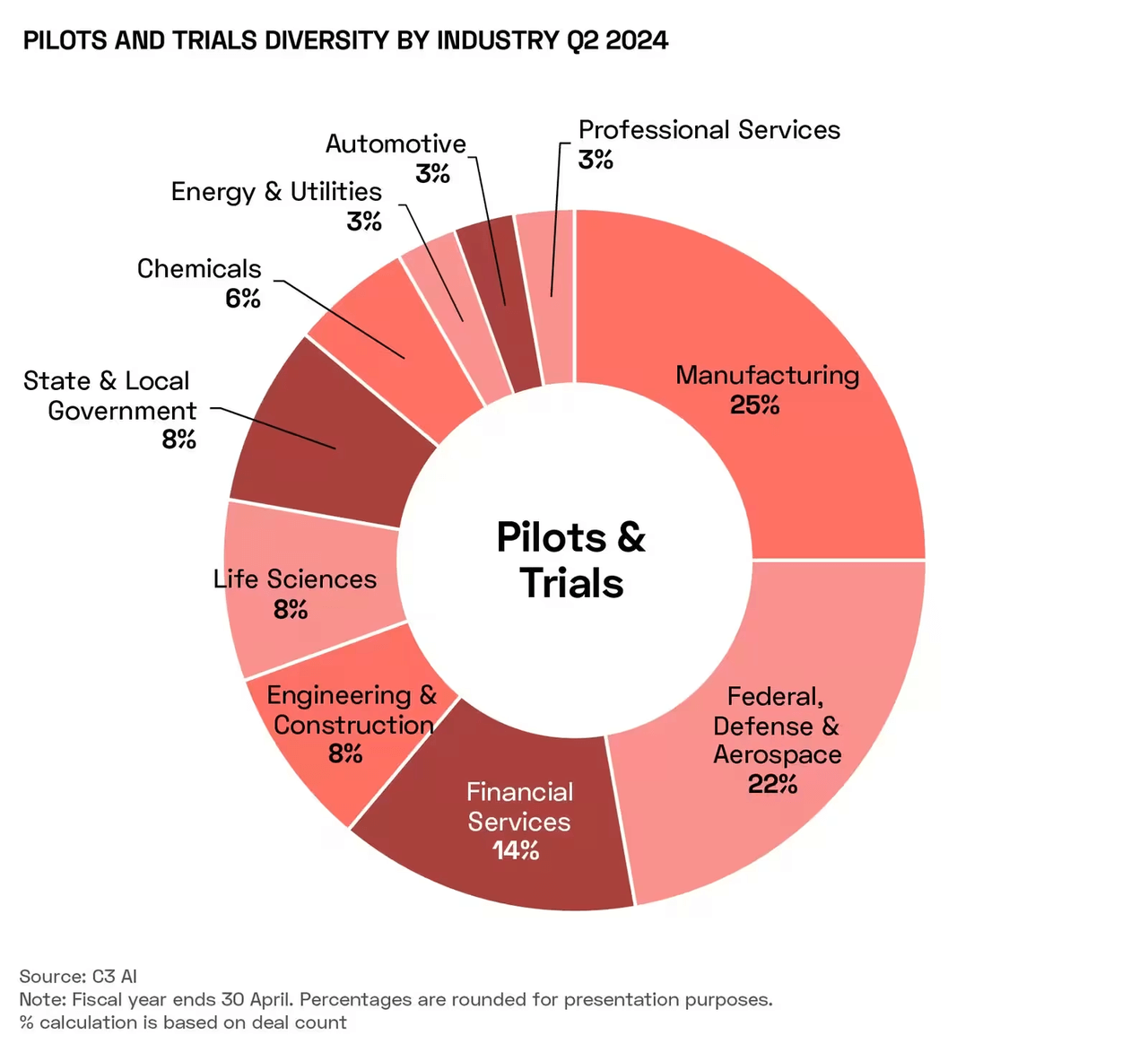

Given its broad range of services and ability to tailor products to industry and demand, C3.AI captures the broad, XFN demand for AI in enterprises. According to a previous quarterly report, nearly half of C3.AI orders came from the federal government, defense and aerospace industries, 19% from manufacturing, 9% from professional services, and 7% from energy and utilities.

And that's not all. If you consider the companies that are piloting or experimenting with their software (i.e. future potential customers), the industry mix that C3.AI are targeting is more evenly distributed. The benefits of diversifying potential customers are obvious, which will bring more guarantees for the stability of their future revenue.

Why are C3.AI optimistic and how to seize the B-end opportunity?

With the continuous evolution of AI technology and the iteration of large models, its business model is also diversifying. Although there are differences in pace between ToB and ToC, both have huge potential yet to be tapped.

For C-end applications, many rigid demands and high-frequency scenarios are currently integrating AI capabilities, driving the improvement of product ARPU and in-app purchase conversion rate. Typical representatives include not only Microsoft Copilot and Notion AI, but also Adobe Firefly and Duolingo Max, which have been deeply analyzed by the RockFlow research team. Work, digital creativity, education, social media, gaming, etc. are all areas worth exploring in the early stages.

In addition, in some vertical scenarios, C-end native AI applications are also emerging, typical representatives are Midjourney, Runway, Character.AI, etc., their scenarios mainly include work, image and video tools, etc.

Outside of the C-end, AI solutions and Enterprise Services platforms for the B-end are obviously a vast blue ocean. Typical representatives are Salesforce, Palantir AIP platform, and Unity AI solution Unity Muse, which is also the opportunity that C3.AI hope to seize.

As mentioned earlier, as the C3.AI knock-out product, the integrated platform C3 AI Suite includes various functional modules such as Data Transmission Service, data management, AI modeling, Machine Learning, predictive analysis, and application development. The platform has high flexibility and scalability, allowing enterprises to customize AI applications according to their own needs.

After C3.AI years of development investment, C3 AI Suite currently has three main capabilities:

C3 AI Suite can collect data from various internal and external data sources, and perform data cleaning and transformation. C3 AI Suite comes with a variety of AI modeling and Machine Learning tools, supporting users to build, train, and deploy complex AI models. C3 AI Suite has powerful predictive analysis capabilities, which can help enterprises predict future trends and optimize decision-making processes.

In addition to its own rich services and powerful platform, C3.AI has continuously expanded its market coverage and enhanced its platform functions and competitiveness through strategic cooperation with many large technology companies:

The recent partnership with Microsoft is a clear priority: C3.AI develop and promote AI solutions with Microsoft, whose Azure Cloud Computing Platform provides robust infrastructure support for C3.AI AI applications, enhancing its platform performance and scalability.

Previously, the cooperation between C3.AI and energy giant Baker Hughes has established a good relationship between the two parties. The C3 AI Suite for Energy jointly launched by the two parties focuses on the management and analysis of energy data, which is the best proof of C3.AI early AI service capabilities and levels.

In addition to the above two examples, the cooperation between C3.AI and Raytheon Technology Company represents the former's strength in the defense and aviation fields. The cooperation projects between the two parties cover multiple business scenarios such as supply chain management, equipment maintenance, and security monitoring, and also lay a solid foundation for C3.AI to further expand its customer categories.

In short, these partnerships not only enable C3.AI to offer customers a wider range of technology options and support, but also help C3.AI increase their visibility and become a key to leveraging more enterprise customers.

C3.AI Financial Performance and Future Catalyst

Since its IPO in 2020, C3.AI's financial performance has been impressive, revenue has continued to grow, and the number of customers has continued to increase. The company has accumulated a rich customer base in multiple industries and operates globally.

From the perspective of revenue, C3.AI's annual revenue has been increasing year by year, especially under the background of strong demand for AI and Big data, the growth momentum is stable; while from the perspective of customer base, as mentioned earlier, C3.AI customers cover multiple industries (energy, manufacturing, finance, medical and defense, etc.), and there are many large enterprises and multinational companies among hundreds of customers worldwide.

C3.AI will release its latest quarterly financial report after the US stock market closes on Wednesday. The market expects the company's latest quarterly revenue to be $84.40 million, a year-on-year increase of 17%; earnings per share are -0.75 US dollars, a year-on-year decrease of 29%.

RockFlow research team believes that with powerful AI technology and extensive industry applications, C3.AI still has good development potential. Future stock price catalysts may include:

Technological innovation and product upgrades. Given that C3.AI has always been committed to technological innovation and continuously improving the performance of its AI platform and applications. Through continuous R & D investment and technological updates, C3.AI is expected to maintain a leading position in the rapidly changing AI market.

Market expansion and customer acquisition. C3.AI is executing its customer acquisition strategy through the following three channels: New market expansion , especially in the Asia-Pacific and European markets. The growing demand for AI and Big data in these regions provides huge market opportunities for C3.AI. Industry Verticalization - C3.AI deeply explores the business needs of various industries and provides more vertical and customized AI solutions. Penetrate the small and medium-sized enterprise market . In addition to large enterprises, it is also actively expanding the small and medium-sized enterprise market, providing them with economical and efficient AI solutions. By reducing technical barriers and providing flexible subscription models, it helps more small and medium-sized enterprises achieve digital transformation.

Geopolitical and policy support. Similar to Palantir, global geopolitical changes and policy support will also have a significant impact on C3.AI's business development. Currently, governments' support policies for AI and Big data technologies are expected to drive their business development. Geopolitical uncertainty may further stimulate the demand for C3.AI products in some categories of enterprises.

It should be pointed out that C3.AI business also has certain risks. Although its revenue is still growing, and a series of businesses such as government customers show signs that future profits may be stable. However, in the past few years, while C3.AI revenue has grown rapidly, net losses have also increased synchronously, which has led to a continuous decline in its gross profit margin. Therefore, it needs to take stricter cost reduction and efficiency improvement measures to improve profitability.

Moreover, as the proportion of C3.AI business in defense, intelligence, and government continues to rise, it may find that quotas in unstable times conflict between corporate interests and national and international security measures. This may cause its development costs to shift from corporate interests to defense interests for a long time, greatly reducing its value to corporate customers and affecting its reputation during peacetime. This means that the relationship between C3.AI and government customers is relatively delicate, and further cooperation between the two parties may not always be beneficial to the company's business.

Conclusion

In the previous quarter, Dell's stock price soared nearly 20% after the financial report was released. The reason was that it benefited from active cooperation with NVIDIA, and AI-optimized server orders increased by nearly 40%, "backlog orders almost doubled". In the same period, C3.AI's performance also exceeded expectations, with a year-on-year increase of 85% in the number of customer agreements signed. Enterprise AI faced "overwhelming demand", which pushed the stock price up 24.52%.

In this financial report, investors will mainly focus on C3.AI's revenue growth rate, guidance and profit margin changes, as well as whether there are more extensive cooperation relationships.

C3.AI is not yet profitable. RockFlow's research team believes that this provides investors with a certain opportunity. When it starts reporting stable returns (or related signs), the market will pay more attention to and recognize the value of the company.

About the Author

The RockFlow research team specializes in long-term analysis of high-quality companies in the US stock market, as well as emerging markets in Latin America and Southeast Asia, focusing on industries with high potential such as cryptocurrencies, biotechnology, and more. The core members of the team come from top technology companies and financial institutions including Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, and CITIC Securities. Many of them have graduated from leading universities such as Massachusetts Institute of Technology (MIT), University of California, Berkeley, Nanyang Technological University, Tsinghua University, and Fudan University.

You can also find us on these platforms: