Highlight:

More than a week after Trump's election, Tesla's stock price rose by nearly 50%. This increased the value of Musk's 411 million shares by nearly $50 billion, equivalent to a staggering 420-fold return on $119 million donated to Trump in just over a week.

Tesla has already tapped almost all the potential from its traditional car business. Musk urgently needs the "next growth point" to make the market recognize Tesla's high valuation. This requires both technological and policy efforts, and Trump will play a key role in the White House.

- The harvest of Musk's bet is not just Tesla. SpaceX, which has become a major partner of NASA, will continue to benefit from government relations. Trump not only praised SpaceX in his victory speech, but also accompanied Musk to attend the Starship launch event, giving him enough face.

- Trump vs. Harris, how investors respond to the election market?

- Why can Nvidia break through 4 trillion?

- Chip king TSMC, where will it go after a trillion-dollar market value?

- When will C3.AI return to the uptrend?

Introduction:

No business boss supports former President Trump's 2024 US election more than Musk. Therefore, after Trump's return to office, no one will win more lucrative rewards than Musk and his business empire.

According to Federal Election Commission documents, Musk has donated nearly 119 million dollars to political action committees supporting Trump, becoming the top financial backer behind Trump. When the Trump team was busy campaigning in swing states at the last minute of the election, Musk was even more willing to risk rule violations by throwing millions of dollars to registered swing state voters every day.

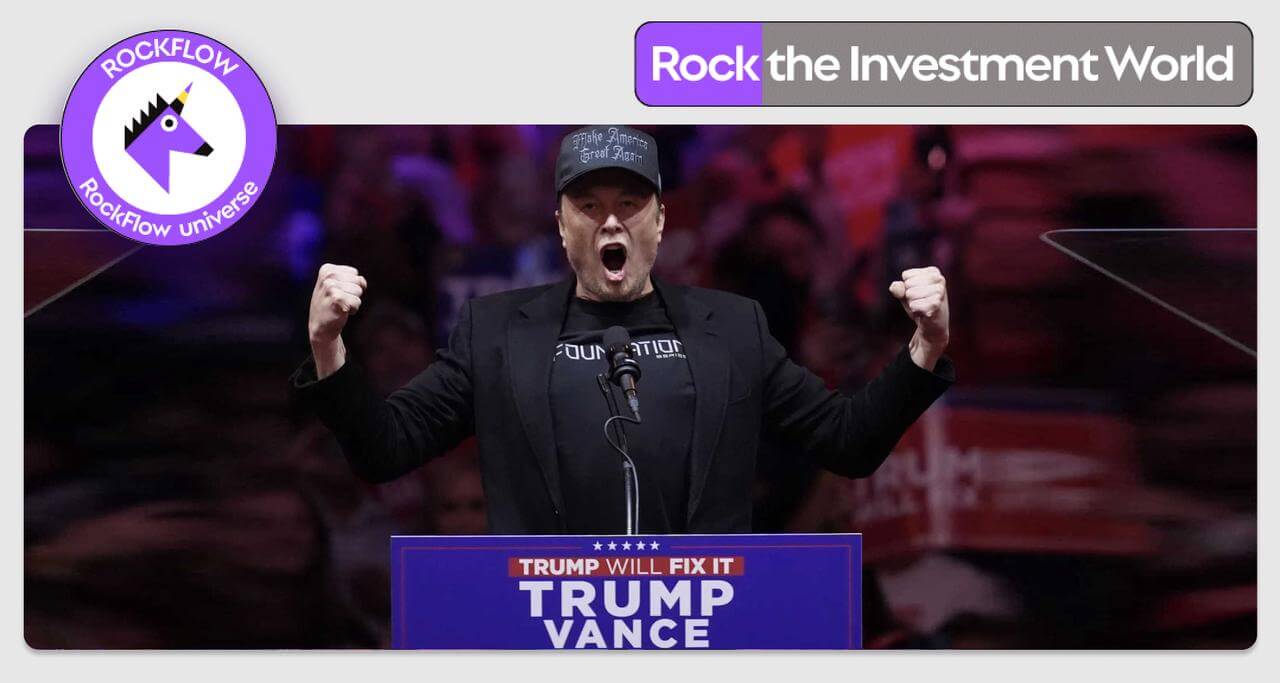

Moreover, in addition to making huge bets with real money, Musk himself frequently speaks out through his privatized social media platform X (formerly Twitter), which cost him billions of dollars, to expand the former president's public opinion. He has also attended rallies and offline gatherings with Trump multiple times, and held a series of town hall meetings in Pennsylvania.

It is not an exaggeration to say that he has put "everything" into Trump's campaign.

Fortunately, Trump's election brought huge returns (and many possibilities in the future) to Musk. Tesla's stock price hit a low of $238 the day before the election, and soared to $358 in the second week of Trump's victory, an increase of nearly 50% in just over a week. This increased the value of Musk's 411 million shares by nearly $50 billion, equivalent to a stunning 420-fold return on $119 million donated to Trump in just over a week. At the same time, Tesla hit a two-year high in stock prices and once again broke through the $1 trillion mark.

1. What does Trump's victory mean for Tesla?

On the day when the election results were about to be announced, Musk posted multiple tweets on X to celebrate Trump's victory.

In one of his tweets, he wrote: "The people of America gave @realDonaldTrump a crystal clear mandate for change tonight."

In fact, Trump did not stand with Musk from the beginning. He advocates the development of the traditional energy industry and has publicly opposed electric vehicles, stating that they are too expensive, have limited range, and will destroy jobs and the US auto industry. But Trump changed his stance in August. "I support electric vehicles. I have to support, you know, because Elon is very supportive of me, so I have no choice."

Trump's election is not good news for the electric vehicle industry, as he will change the policy of the US government strongly supporting the production and purchase of electric vehicles under Biden's leadership, reduce or even stop federal support for electric vehicles, including canceling the $7,500 tax credit provided to electric vehicle buyers.

But for Tesla and Musk, this is by no means a bad thing. Musk posted on X as early as July, saying, "Canceling subsidies will only help Tesla." He is not worried about the end of tax credits, as it will further weaken the motivation and competitiveness of traditional car giants to enter the electric vehicle market.

Due to intensified competition, Tesla's global sales in the first nine months of this year decreased by 2% compared to the same period last year. In the third quarter, Tesla's sales and profits improved, but this is the first time in the company's history that such a large decline has occurred.

Given Tesla's high market share and cost advantage, canceling the electric vehicle tax credit will actually expand its "Competitive Edge". Coupled with Trump's measures to strengthen trade barriers, it may prevent cheaper Chinese electric vehicle manufacturers (such as BYD) from entering the US market in the coming years. This is also good news for Tesla and one of the rewards Musk hopes to obtain.

2. Autonomous driving policies are expected to accelerate approval

Tesla has already tapped into almost all the potential from its traditional car business. Musk urgently needs the "next growth point" to make the market recognize Tesla's much higher valuation than its automotive peers. And the answer he has already given is - robot taxis and autonomous driving. Through the alliance with Trump, Musk has found solid allies in the White House, enough to help Tesla move towards the next stage faster.

Currently, Tesla's driving auxiliary features, namely Autopilot and Fully Autonomous Driving (FSD), have been repeatedly investigated by federal safety regulators due to a series of accidents involving the technology. Although Musk claimed that cars using FSD are safer than human-driven cars, these investigations have clearly slowed down the approval of Tesla's autonomous cars on the road. And because of Trump's presidency, these investigations may gradually be cancelled.

Musk's previous expectation was that Tesla's self-driving taxi would continue testing in 2025 and be launched as early as 2026. Perhaps under the guidance of Trump and new regulatory agencies, Cybercab will hit the road faster than many people imagine.

On November 18th, according to insiders, Trump's transition team has proposed a new plan to make the federal framework for fully autonomous cars a priority for the Department of Transportation. This move will directly benefit Tesla and Musk.

It is understood that the Trump team is considering developing a framework for regulating autonomous cars to overcome current federal regulations that hinder companies such as Tesla from deploying vehicles without steering wheels or pedals. The Trump team is looking for a suitable candidate to lead the Department of Transportation and develop a policy framework for regulating autonomous cars.

Although the Department of Transportation can issue regulations through the National Highway Traffic Safety Administration (NHTSA) to promote the operation of autonomous cars, a congressional bill will pave the way for large-scale adoption of autonomous cars. Insiders said that a bipartisan legislative measure under discussion will establish federal regulations on autonomous cars.

While these discussions are still in their early stages and policy details have yet to be finalized, the move points to a potentially significant shift in the Trump administration's regulatory approach to autonomous cars.

Earlier, Musk announced his support for federal autonomous driving regulations during Tesla's Q3 earnings call on October 23, mentioning that he would push for a process that would allow autonomous cars to be used nationwide. This statement immediately triggered a sell-off in Tesla's competitors Uber and Lyft.

3. Good news for SpaceX, 'Musk deal' is popular

The harvest of Musk's bet is not just Tesla, SpaceX is another important business empire of his. Founded in 2002 to realize his dream of colonizing Mars, SpaceX has the ability to manufacture, launch, recover, and reuse launch vehicles, as well as launch manned spacecraft and satellite systems into various orbits. As the world's largest commercial rocket launch service provider, SpaceX often collaborates with government entities such as NASA, and its latest valuation is as high as $255 billion.

Although SpaceX has not yet gone public, the Closed-End Fund Destiny Tech100 (DXYZ), which holds stocks such as SpaceX and OpenAI, has recently risen several times to circuit breakers and soared nearly 2.8 times within a week after Trump's election.

According to the document released by Destiny Tech100, as of the end of June, the net asset value of the fund was $56 million, and about 38% of its assets were held by SpaceX. This has become an important way for retail investors to invest in SpaceX and pursue the "Musk trade". As investors frenziedly bought in the market, the premium of Destiny Tech100 soared, and the valuation exceeded $400 million, reaching the highest level since April.

SpaceX has always had a deep connection with the US government. More than ten federal agencies such as NASA and the Department of Defense have worked closely with it. According to relevant statistics, in the past decade, US government departments have signed government contracts worth $15.40 billion with Tesla and SpaceX.

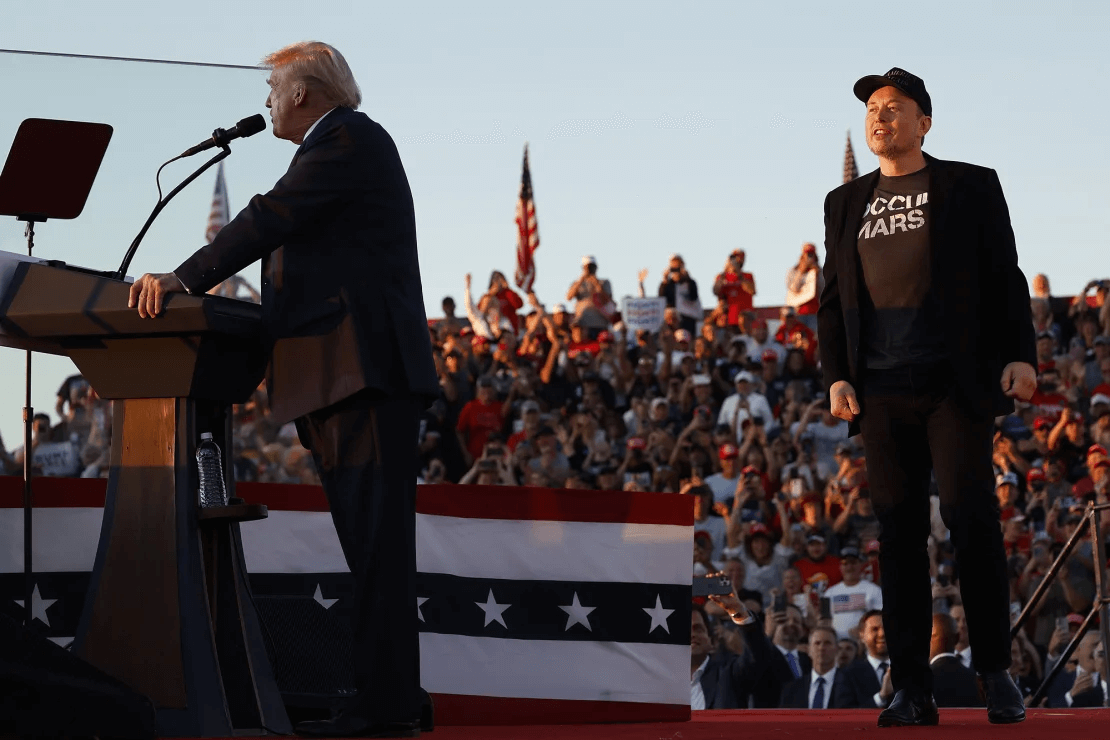

With Trump's election victory, SpaceX, which has become NASA's main partner in space exploration, will continue to benefit from its relationships with NASA and other organizations. Trump not only praised SpaceX's achievements in his victory speech (especially emphasizing their recent feat of returning rocket boosters to the launch pad), but also accompanied Musk to attend the latest Starship launch event recently, giving him face.

In addition, SpaceX mainly competes with Boeing for serious problems in the spacecraft contracted by NASA to transport astronauts to and from the International Space Station. It can be seen that SpaceX is expected to receive more support and achieve immeasurable future achievements. This will also bring great benefits to Musk's future layout.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: